Authors

Summary

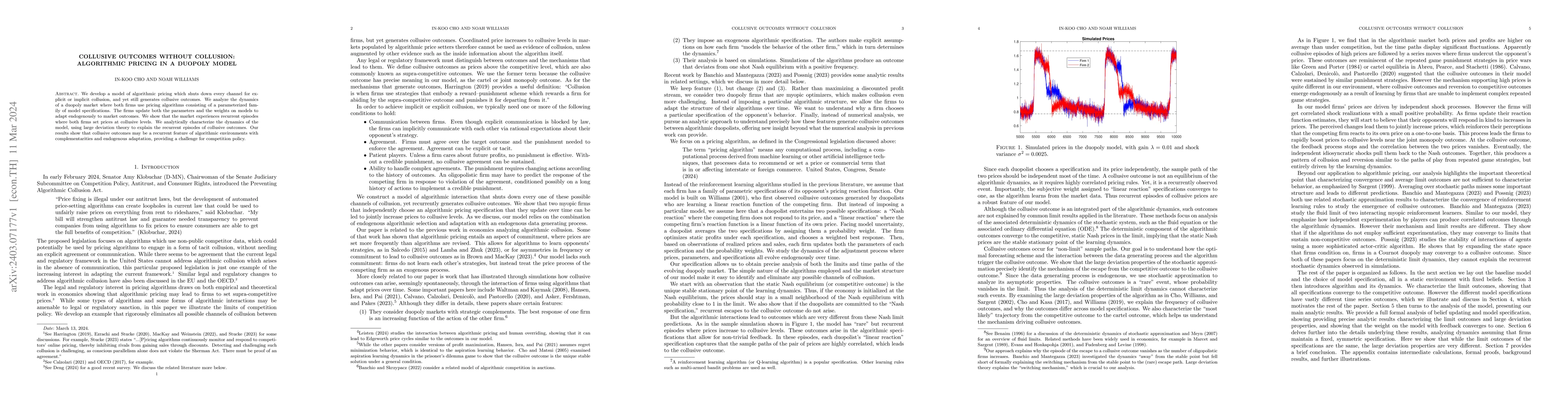

We develop a model of algorithmic pricing that shuts down every channel for explicit or implicit collusion while still generating collusive outcomes. We analyze the dynamics of a duopoly market where both firms use pricing algorithms consisting of a parameterized family of model specifications. The firms update both the parameters and the weights on models to adapt endogenously to market outcomes. We show that the market experiences recurrent episodes where both firms set prices at collusive levels. We analytically characterize the dynamics of the model, using large deviation theory to explain the recurrent episodes of collusive outcomes. Our results show that collusive outcomes may be a recurrent feature of algorithmic environments with complementarities and endogenous adaptation, providing a challenge for competition policy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)