Authors

Summary

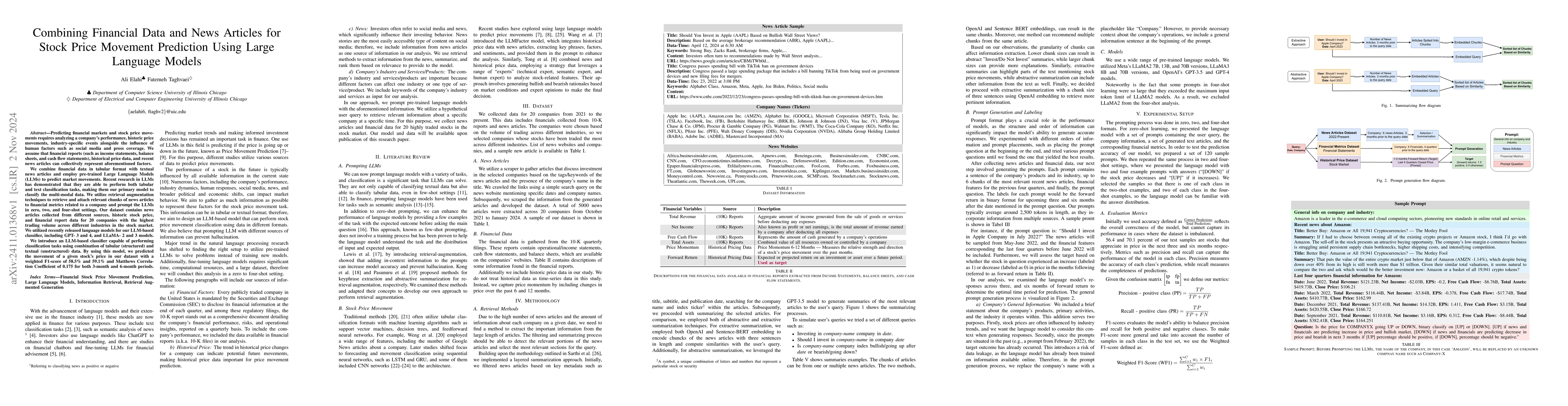

Predicting financial markets and stock price movements requires analyzing a company's performance, historic price movements, industry-specific events alongside the influence of human factors such as social media and press coverage. We assume that financial reports (such as income statements, balance sheets, and cash flow statements), historical price data, and recent news articles can collectively represent aforementioned factors. We combine financial data in tabular format with textual news articles and employ pre-trained Large Language Models (LLMs) to predict market movements. Recent research in LLMs has demonstrated that they are able to perform both tabular and text classification tasks, making them our primary model to classify the multi-modal data. We utilize retrieval augmentation techniques to retrieve and attach relevant chunks of news articles to financial metrics related to a company and prompt the LLMs in zero, two, and four-shot settings. Our dataset contains news articles collected from different sources, historic stock price, and financial report data for 20 companies with the highest trading volume across different industries in the stock market. We utilized recently released language models for our LLM-based classifier, including GPT- 3 and 4, and LLaMA- 2 and 3 models. We introduce an LLM-based classifier capable of performing classification tasks using combination of tabular (structured) and textual (unstructured) data. By using this model, we predicted the movement of a given stock's price in our dataset with a weighted F1-score of 58.5% and 59.1% and Matthews Correlation Coefficient of 0.175 for both 3-month and 6-month periods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImproved Stock Price Movement Classification Using News Articles Based on Embeddings and Label Smoothing

Shaeke Salman, Xiuwen Liu, Luis Villamil et al.

Multimodal Stock Price Prediction

Furkan Karadaş, Bahaeddin Eravcı, Ahmet Murat Özbayoğlu

| Title | Authors | Year | Actions |

|---|

Comments (0)