Authors

Summary

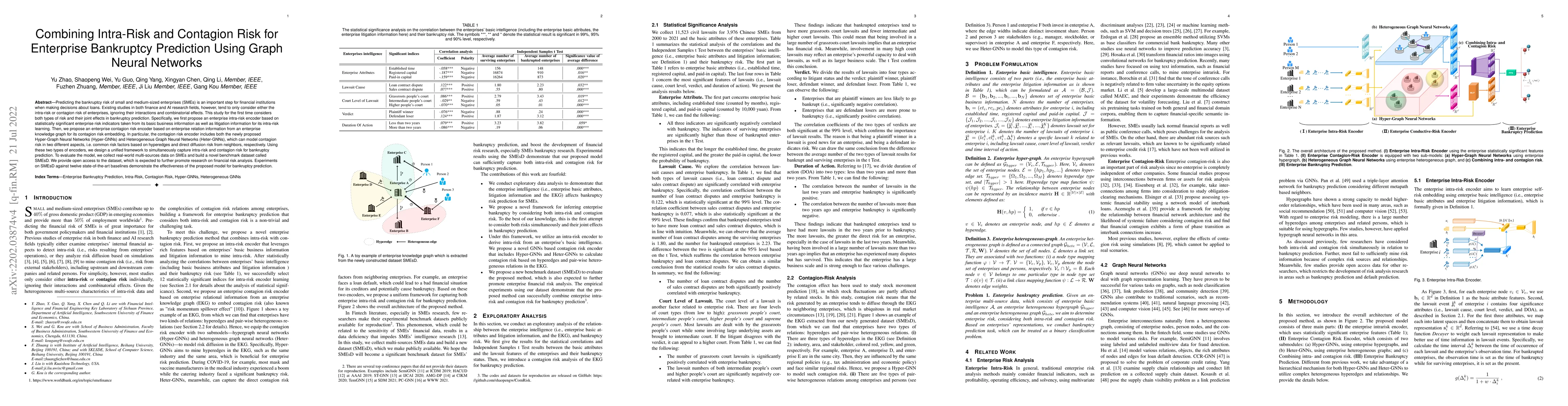

Predicting the bankruptcy risk of small and medium-sized enterprises (SMEs) is an important step for financial institutions when making decisions about loans. Existing studies in both finance and AI research fields, however, tend to only consider either the intra-risk or contagion risk of enterprises, ignoring their interactions and combinatorial effects. This study for the first time considers both types of risk and their joint effects in bankruptcy prediction. Specifically, we first propose an enterprise intra-risk encoder based on statistically significant enterprise risk indicators for its intra-risk learning. Then, we propose an enterprise contagion risk encoder based on enterprise relation information from an enterprise knowledge graph for its contagion risk embedding. In particular, the contagion risk encoder includes both the newly proposed Hyper-Graph Neural Networks and Heterogeneous Graph Neural Networks, which can model contagion risk in two different aspects, i.e. common risk factors based on hyperedges and direct diffusion risk from neighbors, respectively. To evaluate the model, we collect real-world multi-sources data on SMEs and build a novel benchmark dataset called SMEsD. We provide open access to the dataset, which is expected to further promote research on financial risk analysis. Experiments on SMEsD against twelve state-of-the-art baselines demonstrate the effectiveness of the proposed model for bankruptcy prediction.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMeasuring risk contagion in financial networks with CoVaR

Bikramjit Das, Vicky Fasen-Hartmann

Graph Dimension Attention Networks for Enterprise Credit Assessment

Yu Zhao, Fuzhen Zhuang, Shaopeng Wei et al.

Self-explainable Graph Neural Network for Alzheimer's Disease And Related Dementias Risk Prediction

Fang Li, Cui Tao, Xinyue Hu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)