Authors

Summary

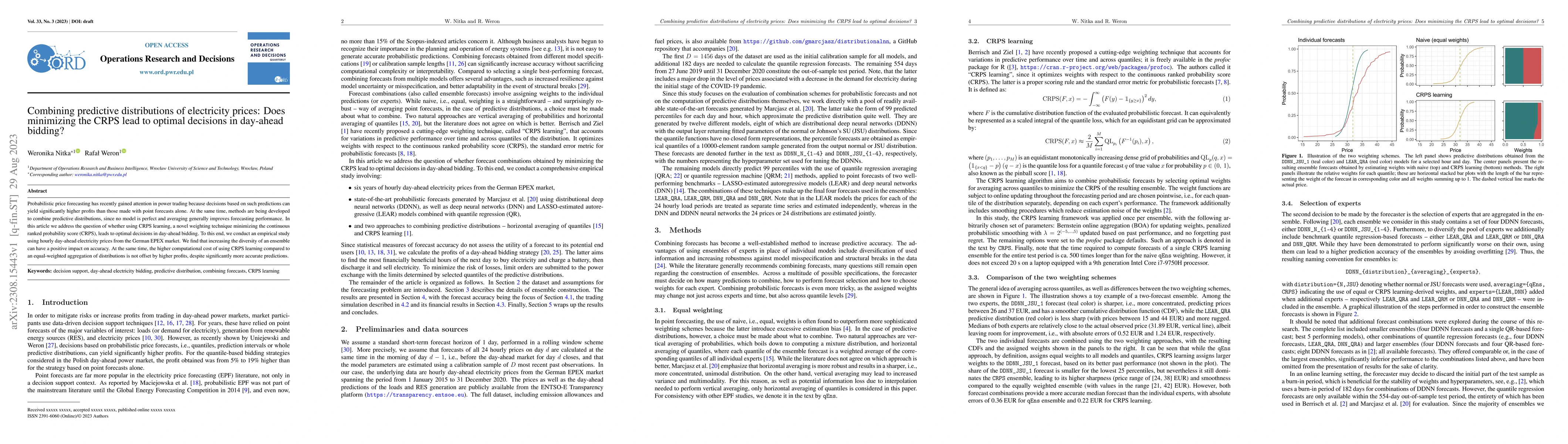

Probabilistic price forecasting has recently gained attention in power trading because decisions based on such predictions can yield significantly higher profits than those made with point forecasts alone. At the same time, methods are being developed to combine predictive distributions, since no model is perfect and averaging generally improves forecasting performance. In this article we address the question of whether using CRPS learning, a novel weighting technique minimizing the continuous ranked probability score (CRPS), leads to optimal decisions in day-ahead bidding. To this end, we conduct an empirical study using hourly day-ahead electricity prices from the German EPEX market. We find that increasing the diversity of an ensemble can have a positive impact on accuracy. At the same time, the higher computational cost of using CRPS learning compared to an equal-weighted aggregation of distributions is not offset by higher profits, despite significantly more accurate predictions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultivariate Probabilistic CRPS Learning with an Application to Day-Ahead Electricity Prices

Jonathan Berrisch, Florian Ziel

Learning Probability Distributions of Day-Ahead Electricity Prices

Jozef Barunik, Lubos Hanus

Optimal bidding in multiperiod day-ahead electricity markets assuming non-uniform uncertainty of clearing prices

Mihály András Vághy, Dávid Csercsik

| Title | Authors | Year | Actions |

|---|

Comments (0)