Summary

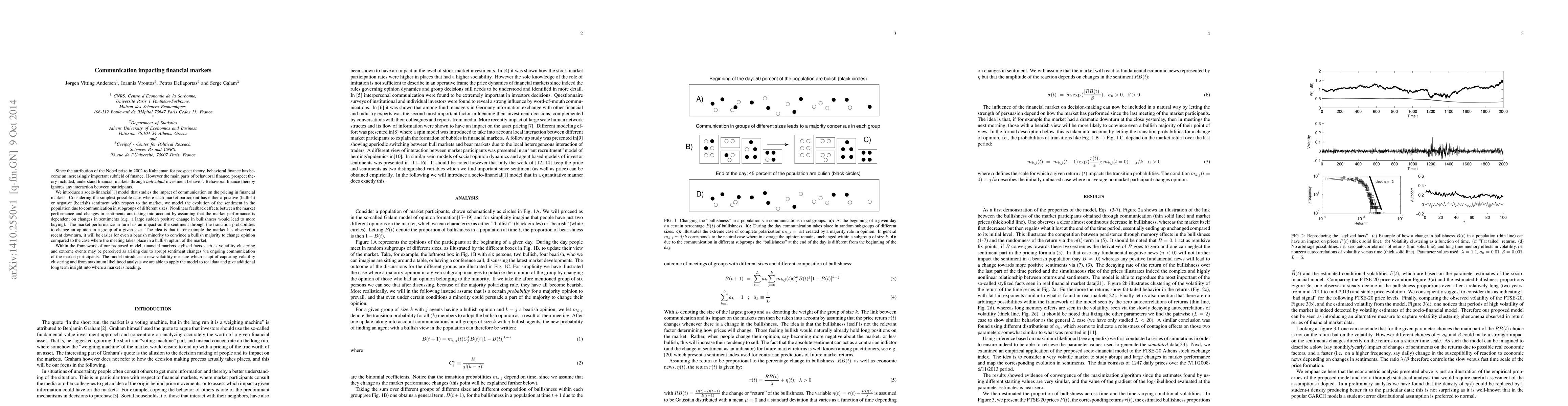

Behavioral finance has become an increasingly important subfield of finance. However the main parts of behavioral finance, prospect theory included, understand financial markets through individual investment behavior. Behavioral finance thereby ignores any interaction between participants. We introduce a socio-financial model that studies the impact of communication on the pricing in financial markets. Considering the simplest possible case where each market participant has either a positive (bullish) or negative (bearish) sentiment with respect to the market, we model the evolution of the sentiment in the population due to communication in subgroups of different sizes. Nonlinear feedback effects between the market performance and changes in sentiments are taking into account by assuming that the market performance is dependent on changes in sentiments (e.g. a large sudden positive change in bullishness would lead to more buying). The market performance in turn has an impact on the sentiment through the transition probabilities to change an opinion in a group of a given size. The idea is that if for example the market has observed a recent downturn, it will be easier for even a bearish minority to convince a bullish majority to change opinion compared to the case where the meeting takes place in a bullish upturn of the market. Within the framework of our proposed model, financial markets stylized facts such as volatility clustering and extreme events may be perceived as arising due to abrupt sentiment changes via ongoing communication of the market participants. The model introduces a new volatility measure which is apt of capturing volatility clustering and from maximum likelihood analysis we are able to apply the model to real data and give additional long term insight into where a market is heading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKites and Quails: Monetary Policy and Communication with Strategic Financial Markets

Giampaolo Bonomi, Ali Uppal

A Comparison between Financial and Gambling Markets

Haoyu Liu, Carl Donovan, Valentin Popov

| Title | Authors | Year | Actions |

|---|

Comments (0)