Summary

The possibility of latency arbitrage in financial markets has led to the deployment of high-speed communication links between distant financial centers. These links are noisy and so there is a need for coding. In this paper, we develop a gametheoretic model of trading behavior where two traders compete to capture latency arbitrage opportunities using binary signalling. Different coding schemes are strategies that trade off between reliability and latency. When one trader has a better channel, the second trader should not compete. With statistically identical channels, we find there are two different regimes of channel noise for which: there is a unique Nash equilibrium yielding ties; and there are two Nash equilibria with different winners.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

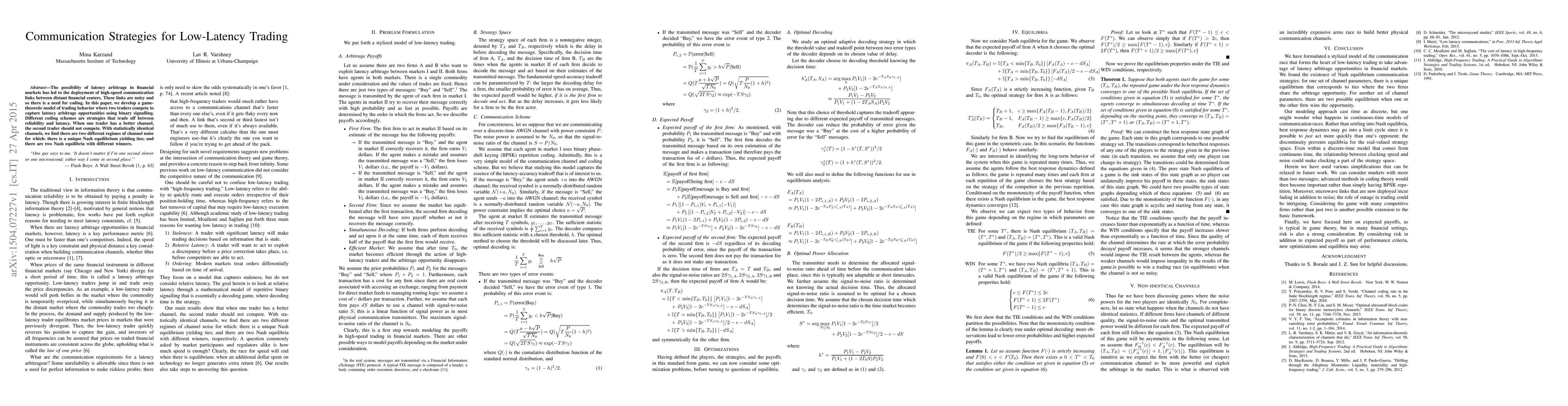

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTrading Datarate for Latency in Quantum Communication

Janis Nötzel, Zuhra Amiri, Florian Seitz

C++ Design Patterns for Low-latency Applications Including High-frequency Trading

Paul Bilokon, Burak Gunduz

| Title | Authors | Year | Actions |

|---|

Comments (0)