Summary

A challenging problem in the study of complex systems is that of resolving, without prior information, the emergent, mesoscopic organization determined by groups of units whose dynamical activity is more strongly correlated internally than with the rest of the system. The existing techniques to filter correlations are not explicitly oriented towards identifying such modules and can suffer from an unavoidable information loss. A promising alternative is that of employing community detection techniques developed in network theory. Unfortunately, this approach has focused predominantly on replacing network data with correlation matrices, a procedure that tends to be intrinsically biased due to its inconsistency with the null hypotheses underlying the existing algorithms. Here we introduce, via a consistent redefinition of null models based on random matrix theory, the appropriate correlation-based counterparts of the most popular community detection techniques. Our methods can filter out both unit-specific noise and system-wide dependencies, and the resulting communities are internally correlated and mutually anti-correlated. We also implement multiresolution and multifrequency approaches revealing hierarchically nested sub-communities with `hard' cores and `soft' peripheries. We apply our techniques to several financial time series and identify mesoscopic groups of stocks which are irreducible to a standard, sectorial taxonomy, detect `soft stocks' that alternate between communities, and discuss implications for portfolio optimization and risk management.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

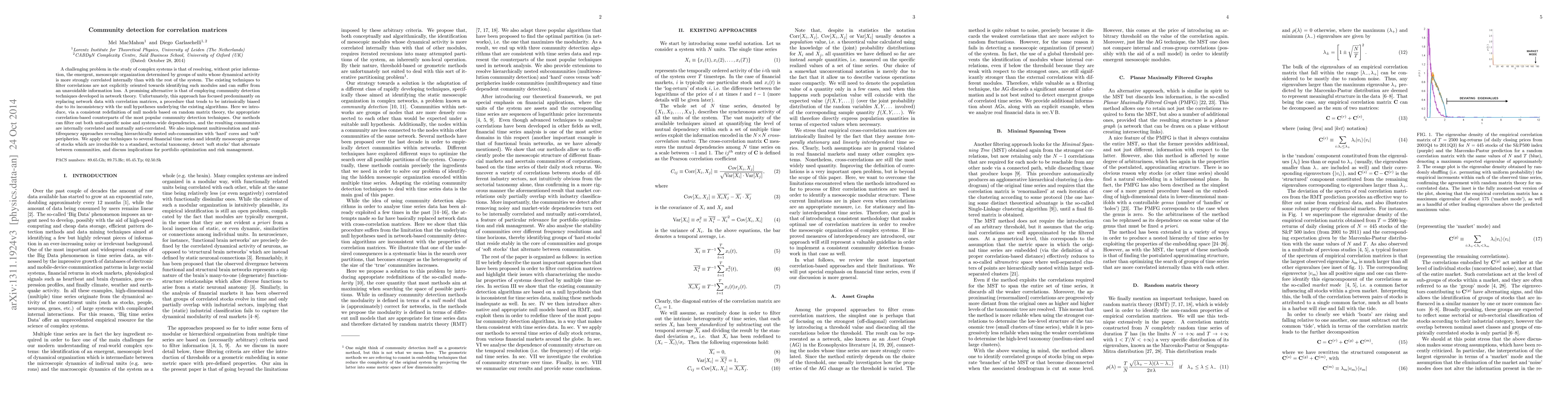

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCorrelation networks, dynamic factor models and community detection

Dhruv Patel, Shankar Bhamidi, Vladas Pipiras et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)