Authors

Summary

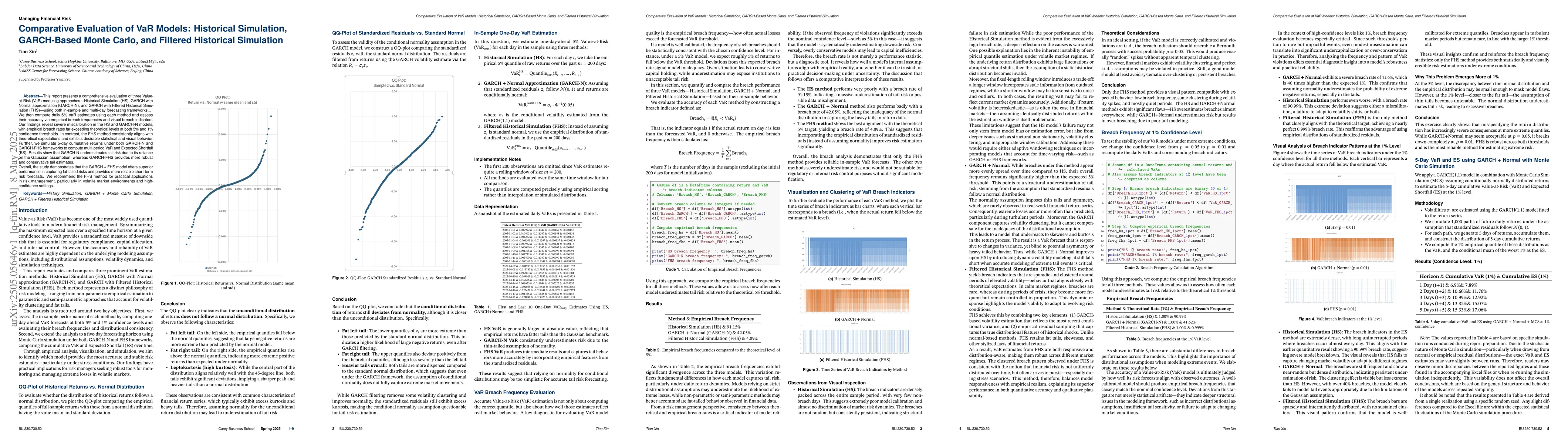

This report presents a comprehensive evaluation of three Value-at-Risk (VaR) modeling approaches: Historical Simulation (HS), GARCH with Normal approximation (GARCH-N), and GARCH with Filtered Historical Simulation (FHS), using both in-sample and multi-day forecasting frameworks. We compute daily 5 percent VaR estimates using each method and assess their accuracy via empirical breach frequencies and visual breach indicators. Our findings reveal severe miscalibration in the HS and GARCH-N models, with empirical breach rates far exceeding theoretical levels. In contrast, the FHS method consistently aligns with theoretical expectations and exhibits desirable statistical and visual behavior. We further simulate 5-day cumulative returns under both GARCH-N and GARCH-FHS frameworks to compute multi-period VaR and Expected Shortfall. Results show that GARCH-N underestimates tail risk due to its reliance on the Gaussian assumption, whereas GARCH-FHS provides more robust and conservative tail estimates. Overall, the study demonstrates that the GARCH-FHS model offers superior performance in capturing fat-tailed risks and provides more reliable short-term risk forecasts.

AI Key Findings

Generated Jun 08, 2025

Methodology

The study evaluates three VaR modeling approaches: Historical Simulation (HS), GARCH with Normal approximation (GARCH-N), and GARCH with Filtered Historical Simulation (FHS), using daily 5% VaR estimates and assessing their accuracy through empirical breach frequencies and visual breach indicators in both in-sample and multi-day forecasting frameworks.

Key Results

- HS and GARCH-N models show severe miscalibration with empirical breach rates exceeding theoretical levels.

- FHS method consistently aligns with theoretical expectations and demonstrates desirable statistical and visual behavior.

- GARCH-N underestimates tail risk due to Gaussian assumption reliance, while GARCH-FHS provides more robust and conservative tail estimates.

- GARCH-FHS model outperforms in capturing fat-tailed risks and offers reliable short-term risk forecasts.

Significance

This research is important as it identifies the superior performance of the GARCH-FHS model in accurately capturing and forecasting tail risks, which is crucial for financial institutions in managing and mitigating potential losses.

Technical Contribution

The paper presents a comparative analysis of HS, GARCH-N, and FHS VaR models, demonstrating the advantages of GARCH-FHS in tail risk estimation and short-term forecasting.

Novelty

This work distinguishes itself by highlighting the shortcomings of HS and GARCH-N in tail risk assessment and emphasizing the GARCH-FHS method's effectiveness in providing more accurate and reliable risk estimates.

Limitations

- The study focuses on specific VaR models and may not generalize to other risk measurement techniques.

- Limited to daily VaR calculations; further research could explore different forecasting horizons.

Future Work

- Investigate the application of GARCH-FHS in various financial contexts and asset classes.

- Explore the integration of GARCH-FHS with other risk management frameworks and models.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDiscrete Hawkes process with flexible residual distribution and filtered historical simulation

Kyungsub Lee

Using quantile time series and historical simulation to forecast financial risk multiple steps ahead

Richard Gerlach, Antonio Naimoli, Giuseppe Storti

No citations found for this paper.

Comments (0)