Summary

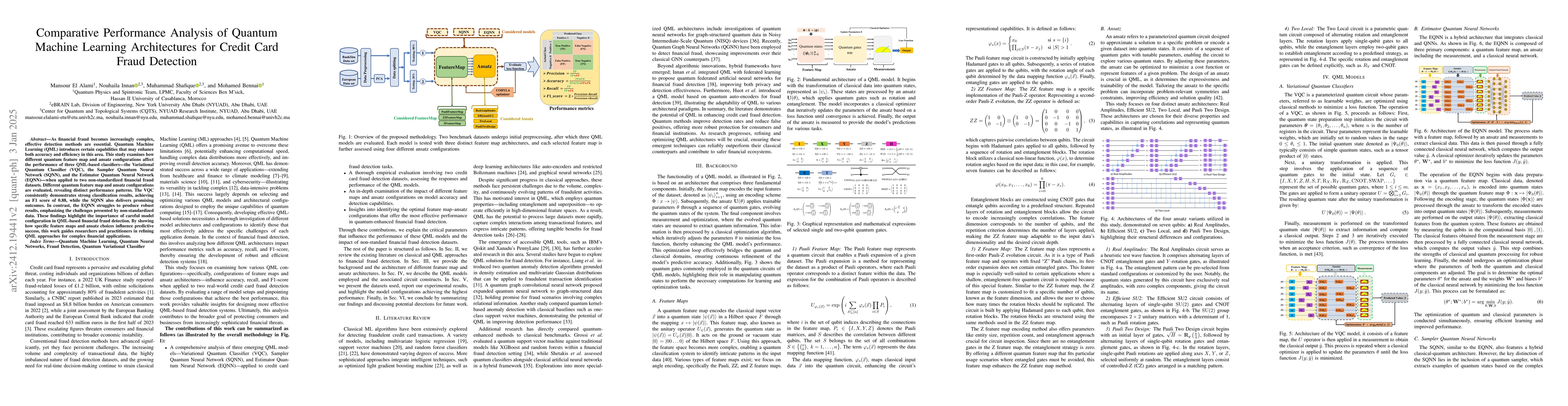

As financial fraud becomes increasingly complex, effective detection methods are essential. Quantum Machine Learning (QML) introduces certain capabilities that may enhance both accuracy and efficiency in this area. This study examines how different quantum feature map and ansatz configurations affect the performance of three QML-based classifiers-the Variational Quantum Classifier (VQC), the Sampler Quantum Neural Network (SQNN), and the Estimator Quantum Neural Network (EQNN)-when applied to two non-standardized financial fraud datasets. Different quantum feature map and ansatz configurations are evaluated, revealing distinct performance patterns. The VQC consistently demonstrates strong classification results, achieving an F1 score of 0.88, while the SQNN also delivers promising outcomes. In contrast, the EQNN struggles to produce robust results, emphasizing the challenges presented by non-standardized data. These findings highlight the importance of careful model configuration in QML-based financial fraud detection. By showing how specific feature maps and ansatz choices influence predictive success, this work guides researchers and practitioners in refining QML approaches for complex financial applications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersCredit Card Fraud Detection: A Deep Learning Approach

Sourav Verma, Joydip Dhar

No citations found for this paper.

Comments (0)