Authors

Summary

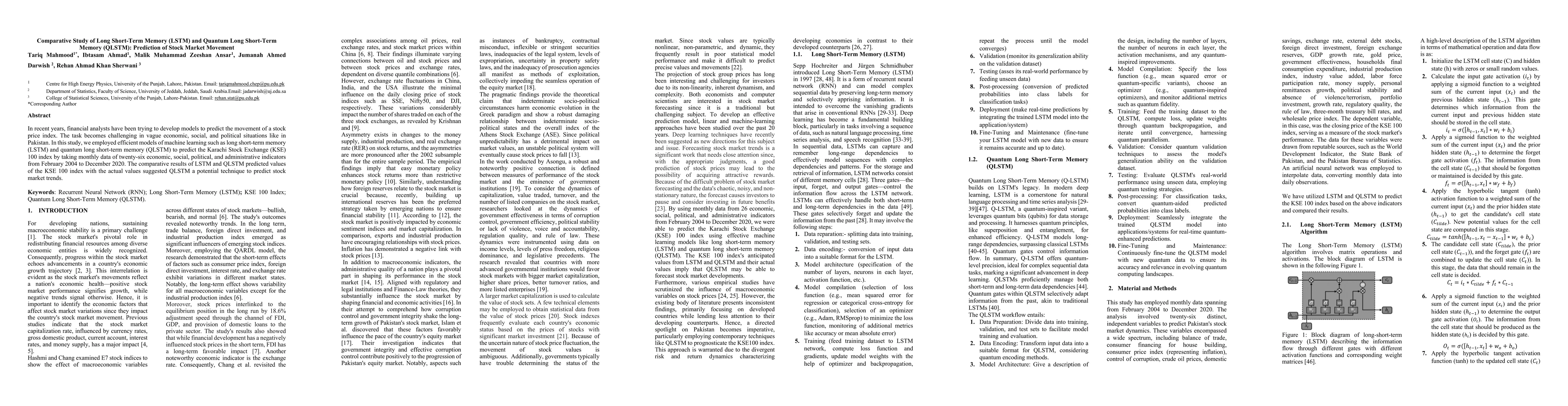

In recent years, financial analysts have been trying to develop models to predict the movement of a stock price index. The task becomes challenging in vague economic, social, and political situations like in Pakistan. In this study, we employed efficient models of machine learning such as long short-term memory (LSTM) and quantum long short-term memory (QLSTM) to predict the Karachi Stock Exchange (KSE) 100 index by taking monthly data of twenty-six economic, social, political, and administrative indicators from February 2004 to December 2020. The comparative results of LSTM and QLSTM predicted values of the KSE 100 index with the actual values suggested QLSTM a potential technique to predict stock market trends.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantum Long Short-Term Memory (QLSTM) vs Classical LSTM in Time Series Forecasting: A Comparative Study in Solar Power Forecasting

Saad Zafar Khan, Nazeefa Muzammil, Salman Ghafoor et al.

Federated Quantum Long Short-term Memory (FedQLSTM)

Shinjae Yoo, Samuel Yen-Chi Chen, Walid Saad et al.

No citations found for this paper.

Comments (0)