Summary

This study aims to compare multiple deep learning-based forecasters for the task of predicting volatility using multivariate data. The paper evaluates a range of models, starting from simpler and shallower ones and progressing to deeper and more complex architectures. Additionally, the performance of these models is compared against naive predictions and variations of classical GARCH models. The prediction of volatility for five assets, namely S&P500, NASDAQ100, gold, silver, and oil, is specifically addressed using GARCH models, Multi-Layer Perceptrons, Recurrent Neural Networks, Temporal Convolutional Networks, and the Temporal Fusion Transformer. In the majority of cases, the Temporal Fusion Transformer, followed by variants of the Temporal Convolutional Network, outperformed classical approaches and shallow networks. These experiments were repeated, and the differences observed between the competing models were found to be statistically significant, thus providing strong encouragement for their practical application.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

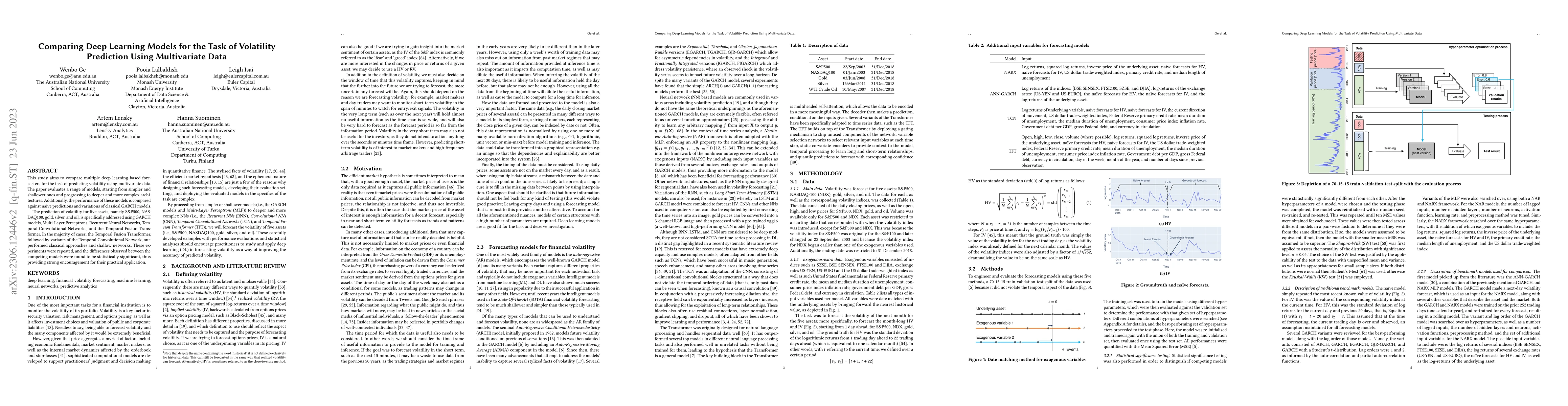

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)