Authors

Summary

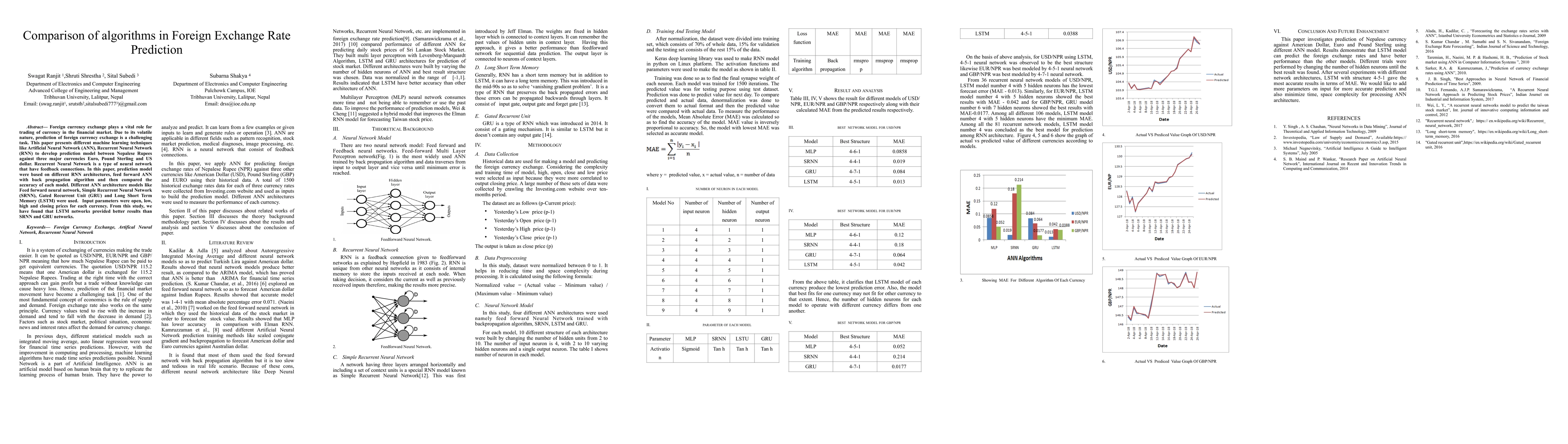

Foreign currency exchange plays a vital role for trading of currency in the financial market. Due to its volatile nature, prediction of foreign currency exchange is a challenging task. This paper presents different machine learning techniques like Artificial Neural Network (ANN), Recurrent Neural Network (RNN) to develop prediction model between Nepalese Rupees against three major currencies Euro, Pound Sterling and US dollar. Recurrent Neural Network is a type of neural network that have feedback connections. In this paper, prediction model were based on different RNN architectures, feed forward ANN with back propagation algorithm and then compared the accuracy of each model. Different ANN architecture models like Feed forward neural network, Simple Recurrent Neural Network (SRNN), Gated Recurrent Unit (GRU) and Long Short Term Memory (LSTM) were used. Input parameters were open, low, high and closing prices for each currency. From this study, we have found that LSTM networks provided better results than SRNN and GRU networks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)