Summary

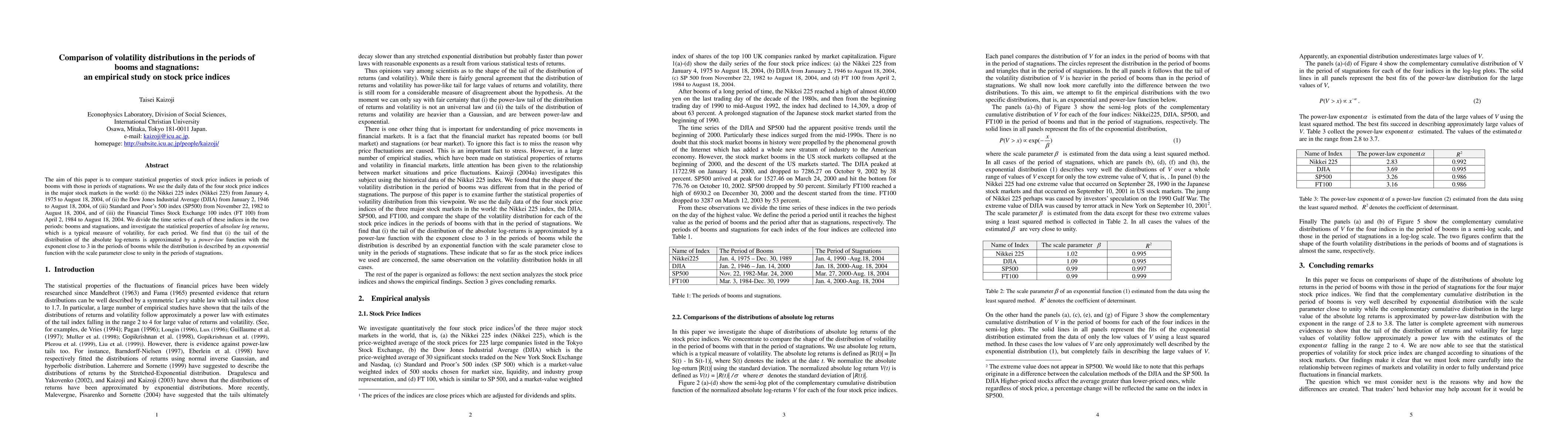

The aim of this paper is to compare statistical properties of stock price indices in periods of booms with those in periods of stagnations. We use the daily data of the four stock price indices in the major stock markets in the world: (i) the Nikkei 225 index (Nikkei 225) from January 4, 1975 to August 18, 2004, of (ii) the Dow Jones Industrial Average (DJIA) from January 2, 1946 to August 18, 2004, of (iii) Standard and Poor's 500 index (SP500) from November 22, 1982 to August 18, 2004, and of (iii) the Financial Times Stock Exchange 100 index (FT 100) from April 2, 1984 to August 18, 2004. We divide the time series of each of these indices in the two periods: booms and stagnations, and investigate the statistical properties of absolute log returns, which is a typical measure of volatility, for each period. We find that (i) the tail of the distribution of the absolute log-returns is approximated by a power-law function with the exponent close to 3 in the periods of booms while the distribution is described by an exponential function with the scale parameter close to unity in the periods of stagnations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)