Summary

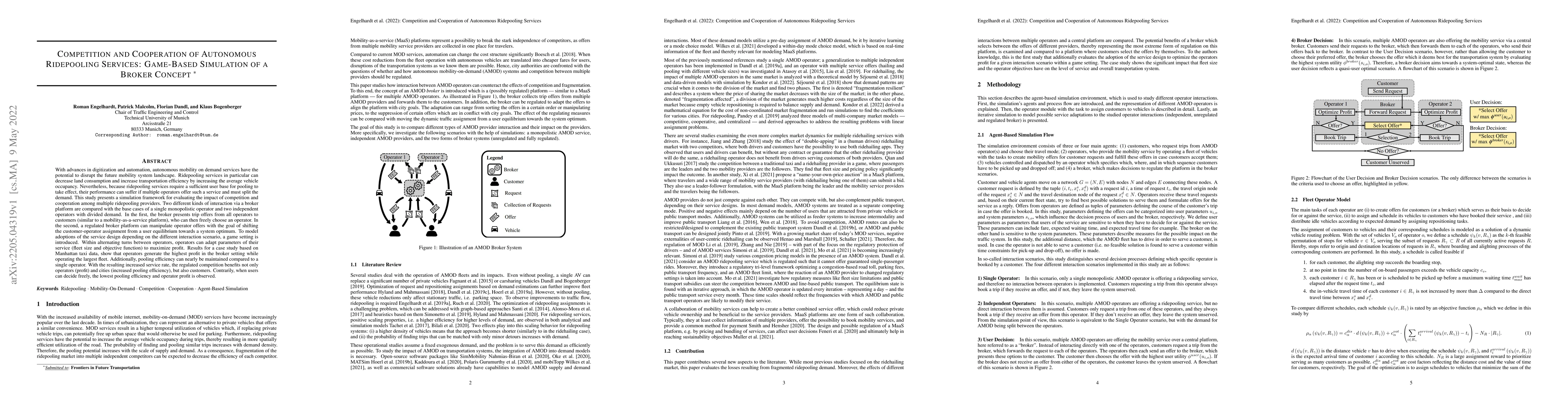

Autonomous mobility on demand services have the potential to disrupt the future mobility system landscape. Ridepooling services in particular can decrease land consumption and increase transportation efficiency by increasing the average vehicle occupancy. Nevertheless, because ridepooling services require a sufficient user base for pooling to take effect, their performance can suffer if multiple operators offer such a service and must split the demand. This study presents a simulation framework for evaluating the impact of competition and cooperation among multiple ridepooling providers. Two different kinds of interaction via a broker platform are compared with the base cases of a single monopolistic operator and two independent operators with divided demand. In the first, the broker presents trip offers from all operators to customers (similar to a mobility-as-a-service platform), who can then freely choose an operator. In the second, a regulated broker platform can manipulate operator offers with the goal of shifting the customer-operator assignment from a user equilibrium towards a system optimum. To model adoptions of the service design depending on the different interaction scenario, a game setting is introduced. Within alternating turns between operators, operators can adapt parameters of their service (fleet size and objective function) to maximize profit. Results for a case study based on Manhattan taxi data, show that operators generate the highest profit in the broker setting while operating the largest fleet. Additionally, pooling efficiency can nearly be maintained compared to a single operator. With the resulting increased service rate, the regulated competition benefits not only operators (profit) and cities (increased pooling efficiency), but also customers. Contrarily, when users can decide freely, the lowest pooling efficiency and operator profit is observed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRidepooling and public bus services: A comparative case-study

Hanno Gottschalk, Kathrin Klamroth, Michael Stiglmayr et al.

Evolution of cooperation and competition in multilayer networks

Xin Wang, Chaoqian Wang, Wenqiang Zhu et al.

A Mean Field Game between Informed Traders and a Broker

Philippe Bergault, Leandro Sánchez-Betancourt

| Title | Authors | Year | Actions |

|---|

Comments (0)