Summary

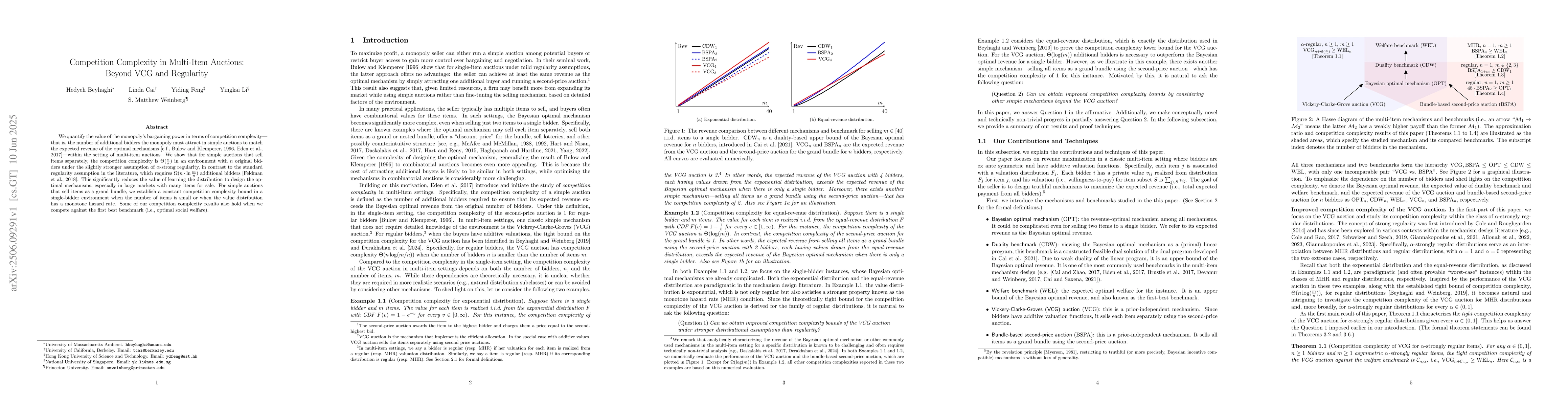

We quantify the value of the monopoly's bargaining power in terms of competition complexity--that is, the number of additional bidders the monopoly must attract in simple auctions to match the expected revenue of the optimal mechanisms (c.f., Bulow and Klemperer, 1996, Eden et al., 2017)--within the setting of multi-item auctions. We show that for simple auctions that sell items separately, the competition complexity is $\Theta(\frac{n}{\alpha})$ in an environment with $n$ original bidders under the slightly stronger assumption of $\alpha$-strong regularity, in contrast to the standard regularity assumption in the literature, which requires $\Omega(n \cdot \ln \frac{m}{n})$ additional bidders (Feldman et al., 2018). This significantly reduces the value of learning the distribution to design the optimal mechanisms, especially in large markets with many items for sale. For simple auctions that sell items as a grand bundle, we establish a constant competition complexity bound in a single-bidder environment when the number of items is small or when the value distribution has a monotone hazard rate. Some of our competition complexity results also hold when we compete against the first best benchmark (i.e., optimal social welfare).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)