Summary

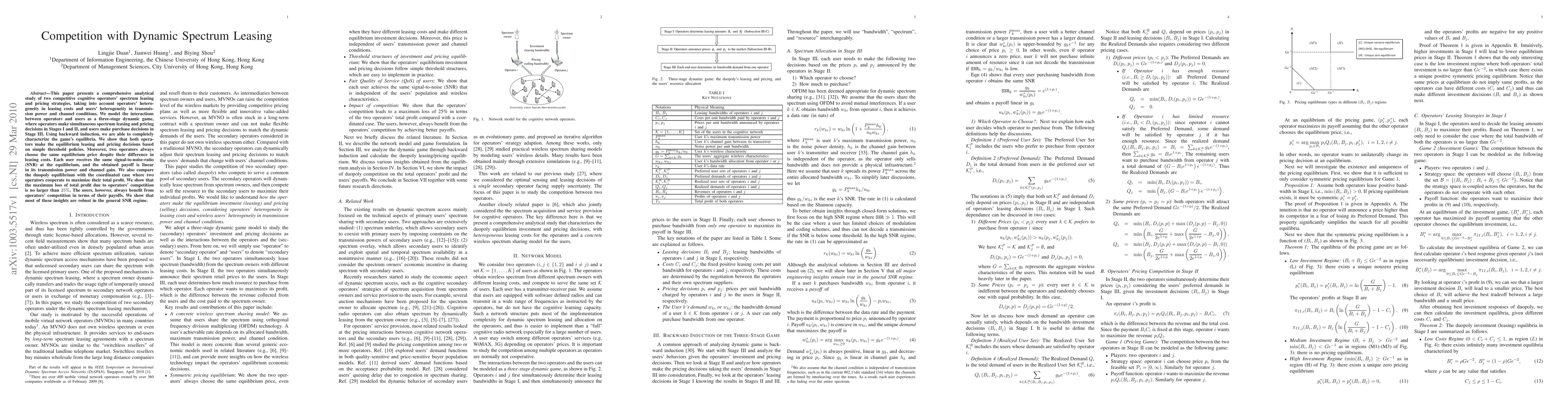

This paper presents a comprehensive analytical study of two competitive cognitive operators' spectrum leasing and pricing strategies, taking into account operators' heterogeneity in leasing costs and users' heterogeneity in transmission power and channel conditions. We model the interactions between operators and users as a three-stage dynamic game, where operators make simultaneous spectrum leasing and pricing decisions in Stages I and II, and users make purchase decisions in Stage III. Using backward induction, we are able to completely characterize the game's equilibria. We show that both operators make the equilibrium leasing and pricing decisions based on simple threshold policies. Moreover, two operators always choose the same equilibrium price despite their difference in leasing costs. Each user receives the same signal-to-noise-ratio (SNR) at the equilibrium, and the obtained payoff is linear in its transmission power and channel gain. We also compare the duopoly equilibrium with the coordinated case where two operators cooperate to maximize their total profit. We show that the maximum loss of total profit due to operators' competition is no larger than 25%. The users, however, always benefit from operators' competition in terms of their payoffs. We show that most of these insights are robust in the general SNR regime.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)