Authors

Summary

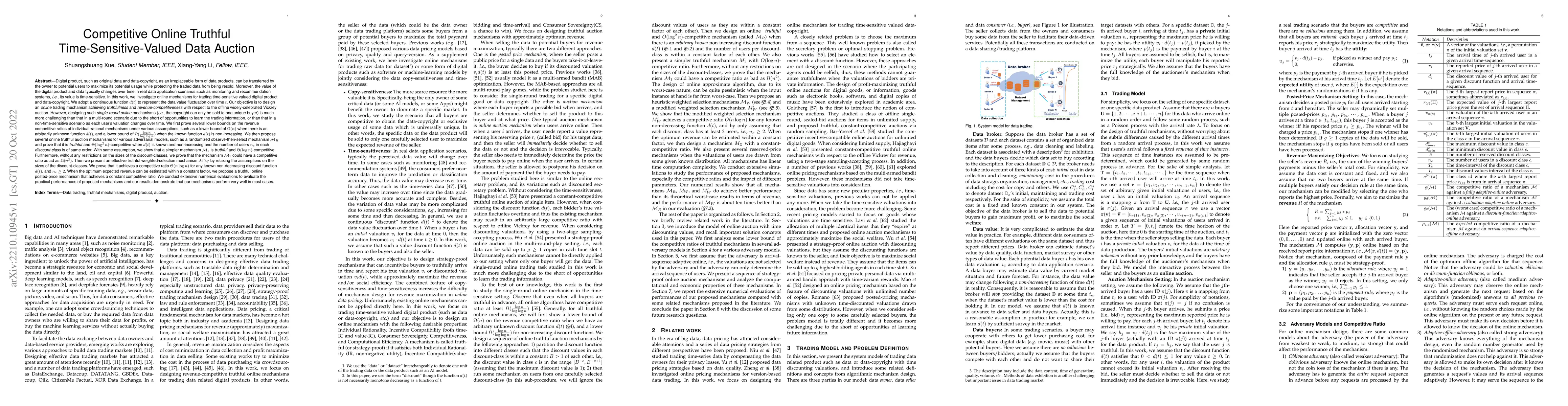

In this work, we investigate online mechanisms for trading time-sensitive valued data. We adopt a continuous function $d(t)$ to represent the data value fluctuation over time $t$. Our objective is to design an \emph{online} mechanism achieving \emph{truthfulness} and \emph{revenue-competitiveness}. We first prove several lower bounds on the revenue competitive ratios under various assumptions. We then propose several online truthful auction mechanisms for various adversarial models, such as a randomized observe-then-select mechanism $\mathcal{M}_1$ and prove that it is \textit{truthful} and $\Theta(\log n)$-competitive under some assumptions. Then we present an effective truthful weighted-selection mechanism $\mathcal{M'}_W$ by relaxing the assumptions on the sizes of the discount-classes. We prove that it achieves a competitive ratio $\Theta(n\log n)$ for any known non-decreasing discount function $d(t)$, and the number of buyers in each discount class $n_c \ge 2$. When the optimum expected revenue $OPT_1$ can be estimated within a constant factor, i.e. $c_0 \cdot OPT_1 \le Z \le OPT_1 $ for some constant $c_0 \in(0,1)$, we propose a truthful online posted-price mechanism that achieves a constant competitive ratio $\frac{4}{c_0}$. Our extensive numerical evaluations demonstrate that our mechanisms perform very well in most cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNeural Myerson Auction for Truthful and Energy-Efficient Autonomous Aerial Data Delivery

Soyi Jung, Joongheon Kim, Sean Kwon et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)