Authors

Summary

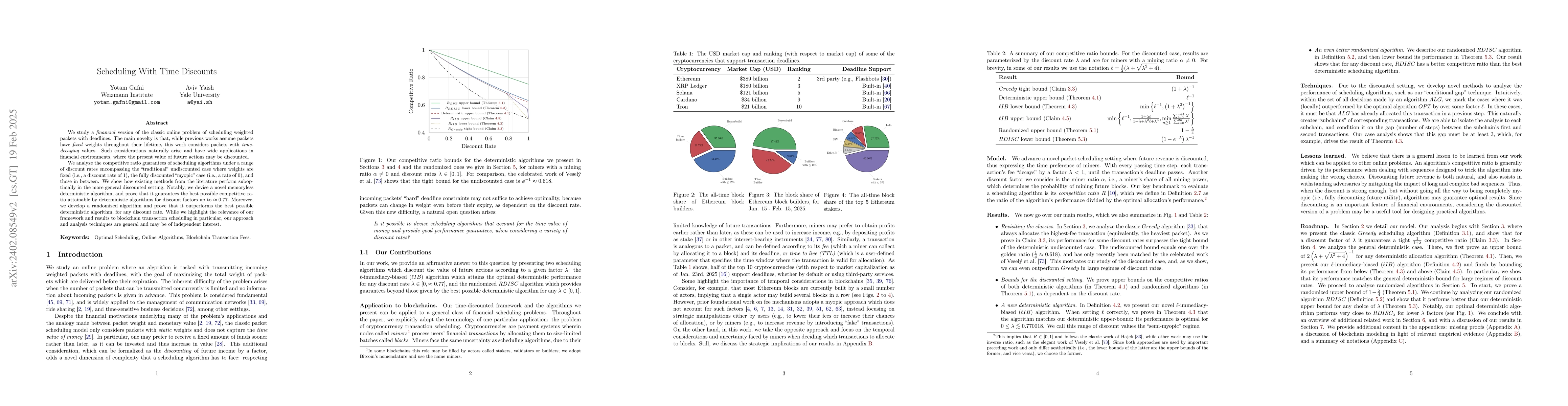

Decentralized cryptocurrencies are payment systems that rely on aligning the incentives of users and miners to operate correctly and offer a high quality of service to users. Recent literature studies the mechanism design problem of the auction serving as a cryptocurrency's transaction fee mechanism (TFM). We find that a non-myopic modelling of miners falls close to another well-known problem: that of online buffer management for packet switching. The main difference is that unlike packets which are of a fixed size throughout their lifetime, in a financial environment, user preferences (and therefore revenue extraction) may be time-dependent. We study the competitive ratio guarantees given a certain discount rate, and show how existing methods from packet scheduling, which we call "the undiscounted case", perform suboptimally in the more general discounted setting. Most notably, we find a novel, simple, memoryless, and optimal deterministic algorithm for the semi-myopic case, when the discount factor is up to ~0.770018. We also present a randomized algorithm that achieves better performance than the best possible deterministic algorithm, for any discount rate.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersShapley Value-based Approach for Redistributing Revenue of Matchmaking of Private Transactions in Blockchains

Yash Chaurasia, Parth Desai, Sujit Gujar et al.

Utilizing Large Language Models for Information Extraction from Real Estate Transactions

Yu Zhao, Haoxiang Gao

| Title | Authors | Year | Actions |

|---|

Comments (0)