Summary

In recent years, data has played an increasingly important role in the economy as a good in its own right. In many settings, data aggregators cannot directly verify the quality of the data they purchase, nor the effort exerted by data sources when creating the data. Recent work has explored mechanisms to ensure that the data sources share high quality data with a single data aggregator, addressing the issue of moral hazard. Oftentimes, there is a unique, socially efficient solution. In this paper, we consider data markets where there is more than one data aggregator. Since data can be cheaply reproduced and transmitted once created, data sources may share the same data with more than one aggregator, leading to free-riding between data aggregators. This coupling can lead to non-uniqueness of equilibria and social inefficiency. We examine a particular class of mechanisms that have received study recently in the literature, and we characterize all the generalized Nash equilibria of the resulting data market. We show that, in contrast to the single-aggregator case, there is either infinitely many generalized Nash equilibria or none. We also provide necessary and sufficient conditions for all equilibria to be socially inefficient. In our analysis, we identify the components of these mechanisms which give rise to these undesirable outcomes, showing the need for research into mechanisms for competitive settings with multiple data purchasers and sellers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

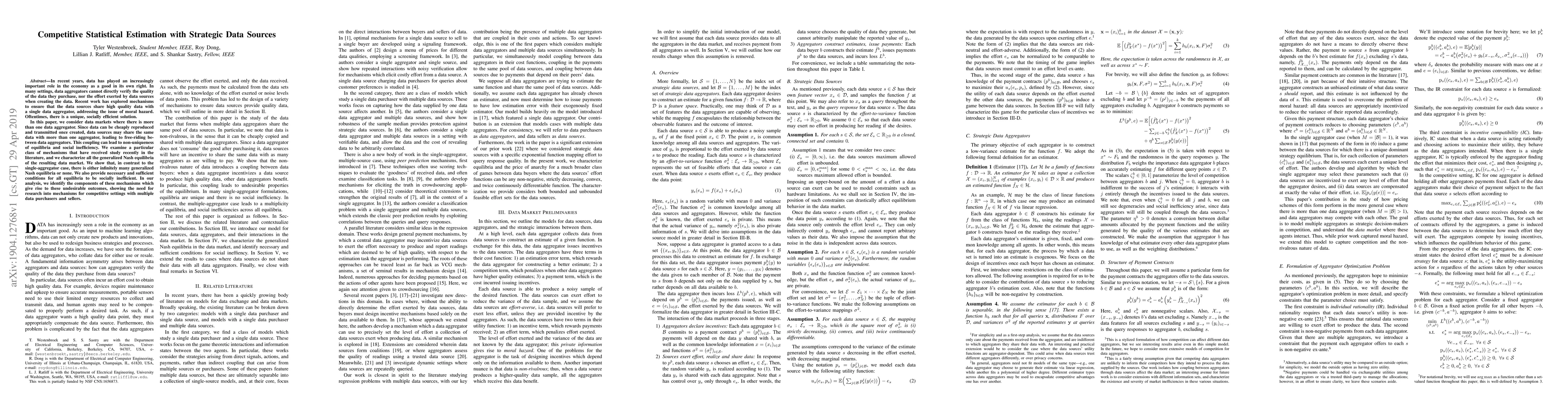

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)