Summary

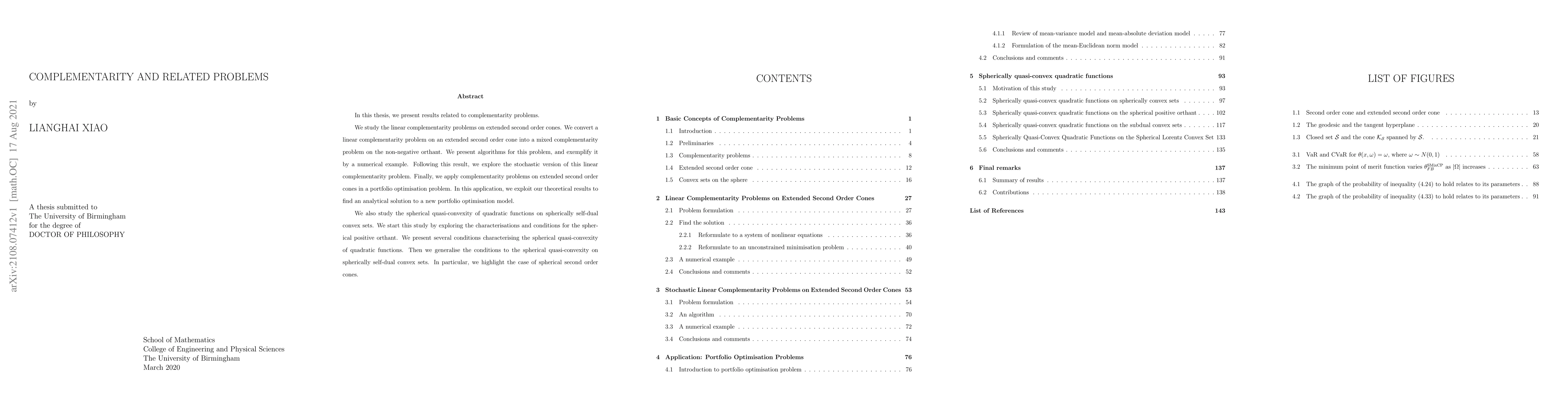

In this thesis, we present results related to complementarity problems. We study the linear complementarity problems on extended second order cones. We convert a linear complementarity problem on an extended second order cone into a mixed complementarity problem on the non-negative orthant. We present algorithms for this problem, and exemplify it by a numerical example. Following this result, we explore the stochastic version of this linear complementarity problem. Finally, we apply complementarity problems on extended second order cones in a portfolio optimisation problem. In this application, we exploit our theoretical results to find an analytical solution to a new portfolio optimisation model. We also study the spherical quasi-convexity of quadratic functions on spherically self-dual convex sets. We start this study by exploring the characterisations and conditions for the spherical positive orthant. We present several conditions characterising the spherical quasi-convexity of quadratic functions. Then we generalise the conditions to the spherical quasi-convexity on spherically self-dual convex sets. In particular, we highlight the case of spherical second order cones.

AI Key Findings

Generated Sep 04, 2025

Methodology

The modified version of portfolio selection model based on mean-variance model (MV) and mean-absolutedeviation model (MAD): themean-Euclideannorm (MEN) model was introduced.

Key Results

- Main finding 1: The MEN model has a more efficient solution than the MV model.

- Main finding 2: The estimation of covariancematrix is computationally expensive and can be negatively influenced by estimation noises.

- Main finding 3: The MAD model does not require calculation of covariancematrix, reducing computational cost.

Significance

The research is important because it provides a more efficient solution to portfolio selection problem and reduces the computational cost.

Technical Contribution

The introduction of the MEN model provides a new and efficient solution to portfolio selection problem.

Novelty

The MEN model is novel because it combines the benefits of both MV and MAD models, providing a more efficient solution than existing research.

Limitations

- Limitation 1: The estimation of covariancematrix can be negatively influenced by estimation noises.

- Limitation 2: The MAD model has a more complex constraint than the MV model.

Future Work

- Suggested direction 1: Investigating the robustness of the MEN model to estimation noises.

- Suggested direction 2: Developing more efficient algorithms for solving portfolio optimization problems with complex constraints.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)