Summary

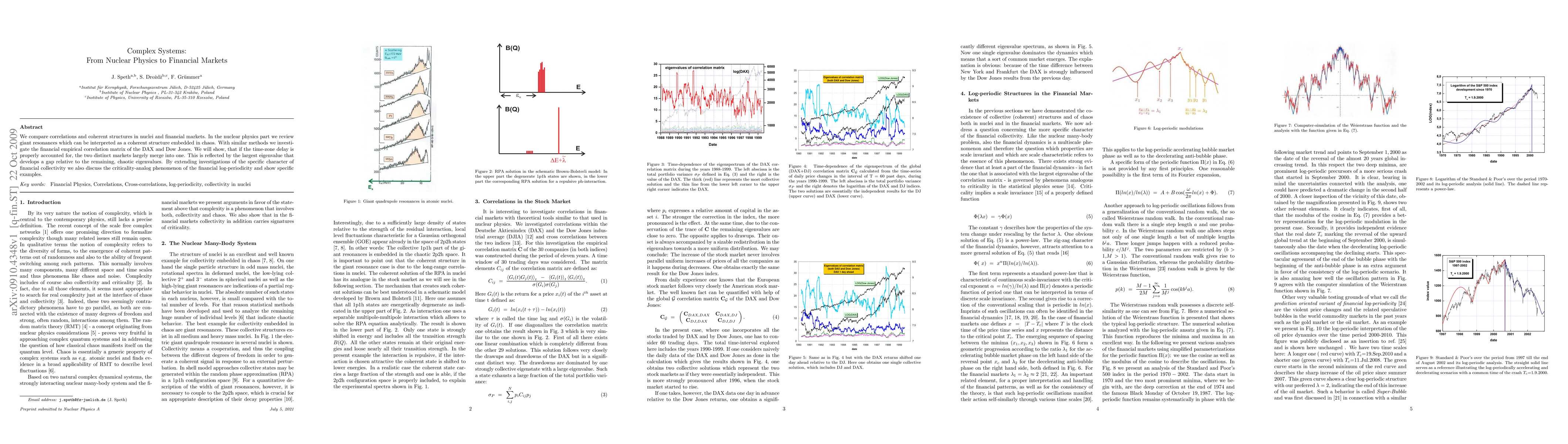

We compare correlations and coherent structures in nuclei and financial markets. In the nuclear physics part we review giant resonances which can be interpreted as a coherent structure embedded in chaos. With similar methods we investigate the financial empirical correlation matrix of the DAX and Dow Jones. We will show, that if the time-zone delay is properly accounted for, the two distinct markets largely merge into one. This is reflected by the largest eigenvalue that develops a gap relative to the remaining, chaotic eigenvalues. By extending investigations of the specific character of financial collectivity we also discuss the criticality-analog phenomenon of the financial log-periodicity and show specific examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)