Summary

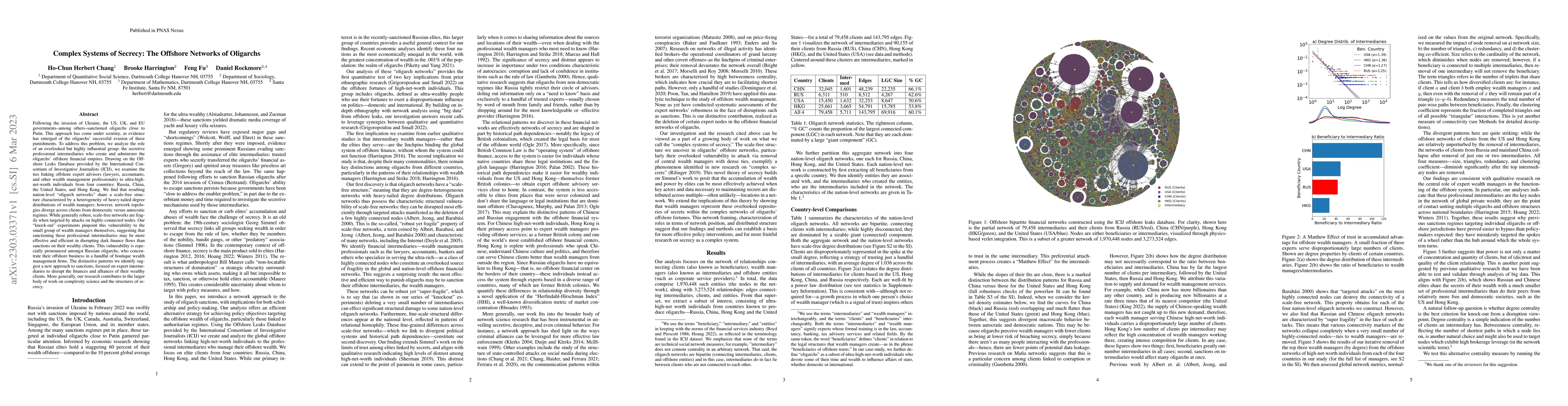

Following the invasion of Ukraine, the US, UK, and EU governments--among others--sanctioned oligarchs close to Putin. This approach has come under scrutiny, as evidence has emerged of the oligarchs' successful evasion of these punishments. To address this problem, we analyze the role of an overlooked but highly influential group: the secretive professional intermediaries who create and administer the oligarchs' offshore financial empires. Drawing on the Offshore Leaks Database provided by the International Consortium of Investigative Journalists (ICIJ), we examine the ties linking offshore expert advisors (lawyers, accountants, and other wealth management professionals) to ultra-high-net-worth individuals from four countries: Russia, China, the United States, and Hong Kong. We find that resulting nation-level "oligarch networks" share a scale-free structure characterized by heterogeneity of heavy-tailed degree distributions of wealth managers; however, network topologies diverge across clients from democratic versus autocratic regimes. While generally robust, scale-free networks are fragile when targeted by attacks on highly-connected nodes. Our "knock-out" experiments pinpoint this vulnerability to the small group of wealth managers themselves, suggesting that sanctioning these professional intermediaries may be more effective and efficient in disrupting dark finance flows than sanctions on their wealthy clients. This vulnerability is especially pronounced amongst Russian oligarchs, who concentrate their offshore business in a handful of boutique wealth management firms. The distinctive patterns we identify suggest a new approach to sanctions, focused on expert intermediaries to disrupt the finances and alliances of their wealthy clients. More generally, our research contributes to the larger body of work on complexity science and the structures of secrecy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSecrecy strategies: Global patterns in elites' quest for confidentiality in offshore finance.

Chang, Ho-Chun Herbert, Harrington, Brooke, Rockmore, Daniel

On the Average Secrecy Performance of Satellite Networks in Short Packet Communication Systems

Risto Wichman, Ramin Hashemi, Graciela Corral Briones

| Title | Authors | Year | Actions |

|---|

Comments (0)