Summary

Conventional economic analysis of stringent climate change mitigation policy generally concludes various levels of economic slowdown as a result of substantial spending on low carbon technology. Equilibrium economics however could not explain or predict the current economic crisis, which is of financial nature. Meanwhile the economic impacts of climate policy find their source through investments for the diffusion of environmental innovations, in parts a financial problem. Here, we expose how results of economic analysis of climate change mitigation policy depend entirely on assumptions and theory concerning the finance of the diffusion of innovations, and that in many cases, results are simply re-iterations of model assumptions. We show that, while equilibrium economics always predict economic slowdown, methods using non-equilibrium approaches suggest the opposite could occur. We show that the solution to understanding the economic impacts of reducing greenhouse gas emissions lies with research on the dynamics of the financial sector interacting with innovation and technology developments, economic history providing powerful insights through important analogies with previous historical waves of innovation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

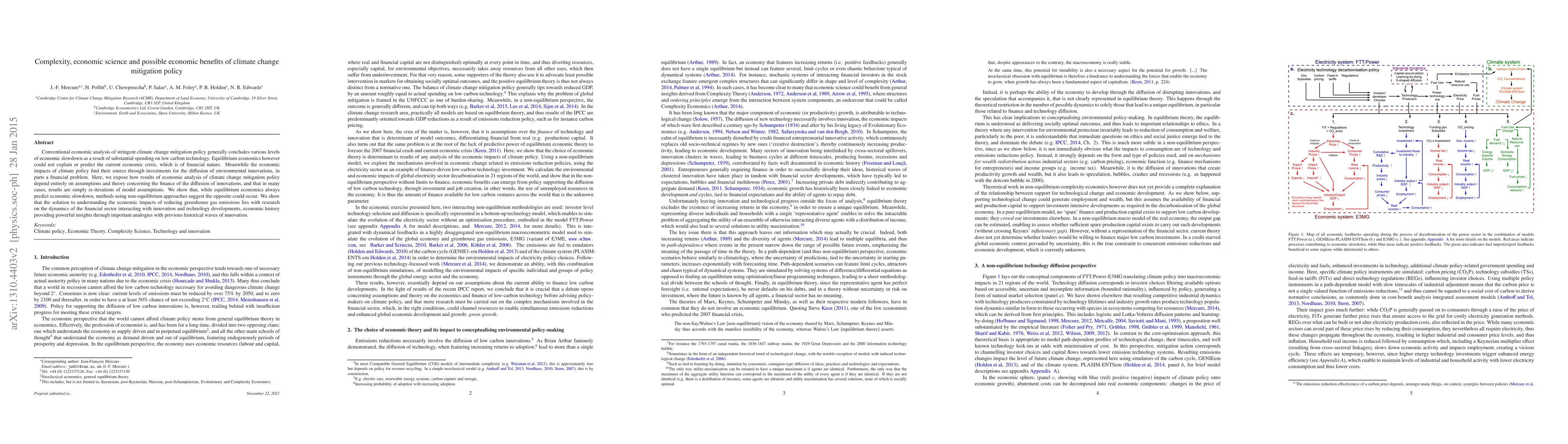

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)