Summary

We employed Multifractal Detrended Fluctuation Analysis (MF-DFA) and Refined Composite Multiscale Sample Entropy (RCMSE) to investigate the complexity of Bitcoin, GBP/USD, gold, and natural gas price log-return time series. This study provides a comparative analysis of these markets and offers insights into their predictability and associated risks. Each tool presents a unique method to quantify time series complexity. The RCMSE and MF-DFA methods demonstrate a higher complexity for the Bitcoin time series than others. It is discussed that the increased complexity of Bitcoin may be attributable to the presence of higher nonlinear correlations within its log-return time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

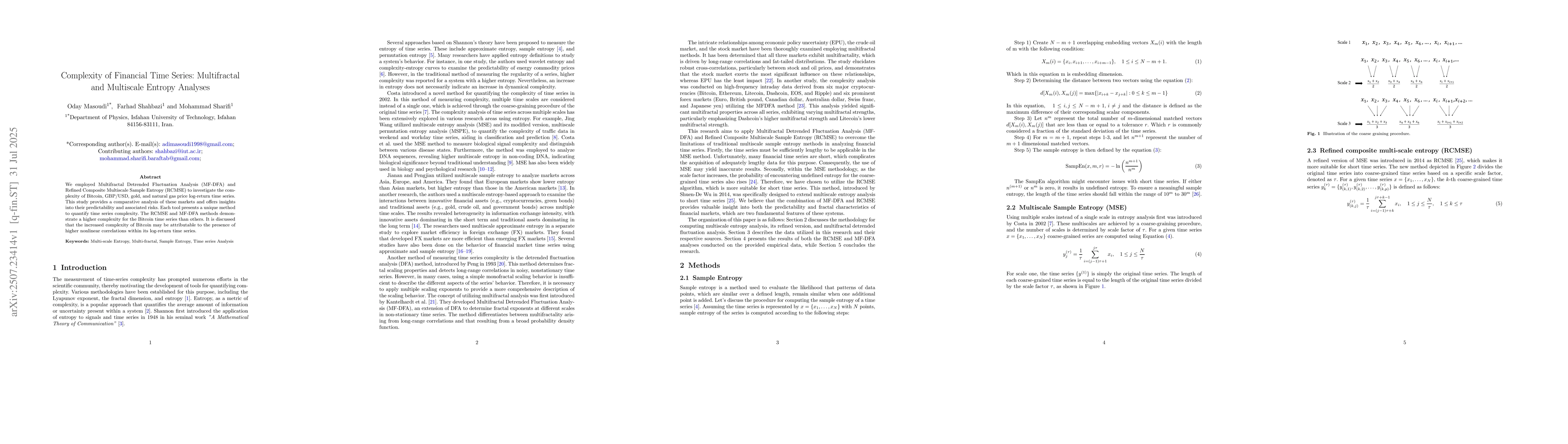

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultifractal analysis of financial markets

Wei-Xing Zhou, Wen-Jie Xie, Didier Sornette et al.

No citations found for this paper.

Comments (0)