Authors

Summary

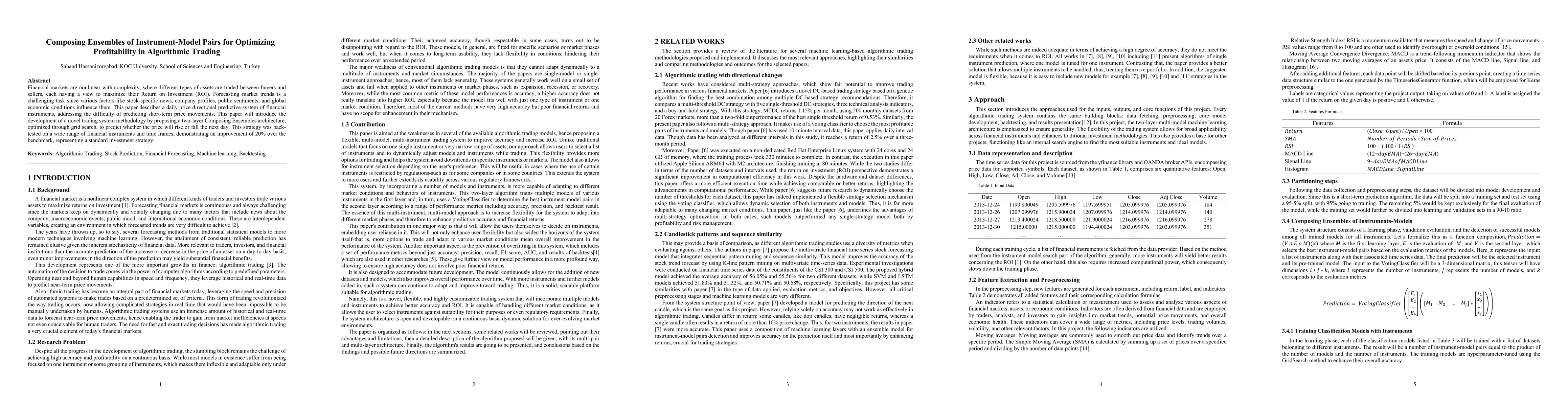

Financial markets are nonlinear with complexity, where different types of assets are traded between buyers and sellers, each having a view to maximize their Return on Investment (ROI). Forecasting market trends is a challenging task since various factors like stock-specific news, company profiles, public sentiments, and global economic conditions influence them. This paper describes a daily price directional predictive system of financial instruments, addressing the difficulty of predicting short-term price movements. This paper will introduce the development of a novel trading system methodology by proposing a two-layer Composing Ensembles architecture, optimized through grid search, to predict whether the price will rise or fall the next day. This strategy was back-tested on a wide range of financial instruments and time frames, demonstrating an improvement of 20% over the benchmark, representing a standard investment strategy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)