Summary

We introduce the conditional Maximum Composite Likelihood (MCL) estimation method for the stochastic factor ordered Probit model of credit rating transitions of firms. This model is recommended for internal credit risk assessment procedures in banks and financial institutions under the Basel III regulations. Its exact likelihood function involves a high-dimensional integral, which can be approximated numerically before maximization. However, the estimated migration risk and required capital tend to be sensitive to the quality of this approximation, potentially leading to statistical regulatory arbitrage. The proposed conditional MCL estimator circumvents this problem and maximizes the composite log-likelihood of the factor ordered Probit model. We present three conditional MCL estimators of different complexity and examine their consistency and asymptotic normality when n and T tend to infinity. The performance of these estimators at finite T is examined and compared with a granularity-based approach in a simulation study. The use of the MCL estimator is also illustrated in an empirical application.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

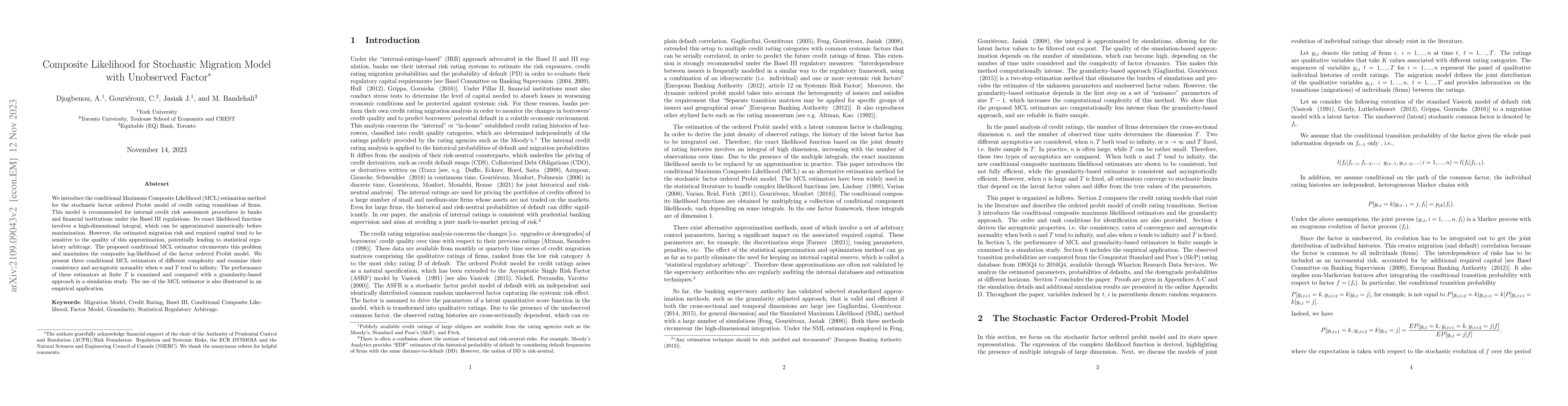

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWhen Composite Likelihood Meets Stochastic Approximation

Yunxiao Chen, Irini Moustaki, Giuseppe Alfonzetti et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)