Authors

Summary

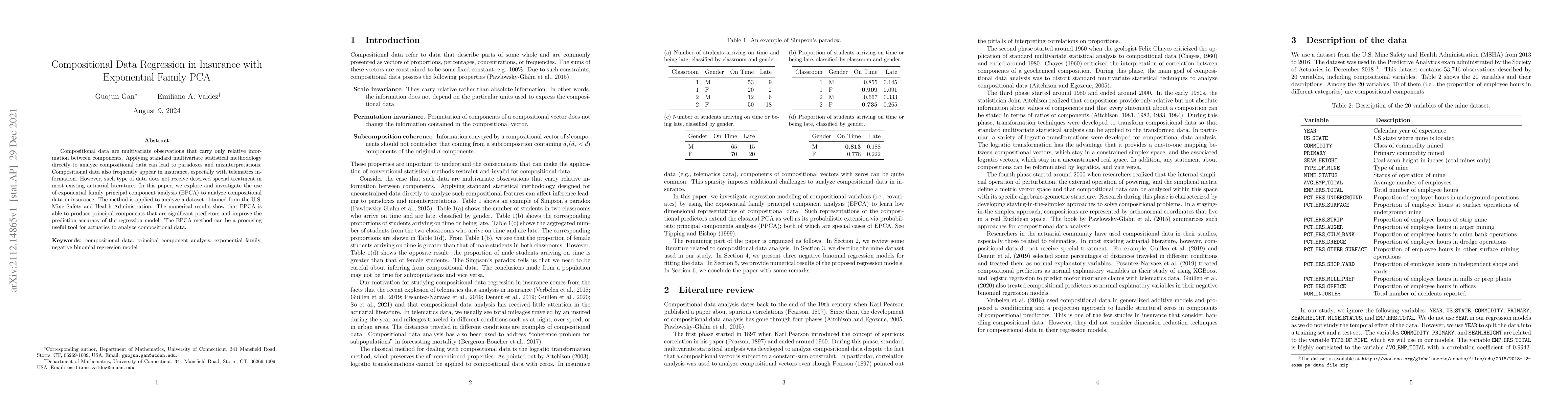

Compositional data are multivariate observations that carry only relative information between components. Applying standard multivariate statistical methodology directly to analyze compositional data can lead to paradoxes and misinterpretations. Compositional data also frequently appear in insurance, especially with telematics information. However, such type of data does not receive deserved special treatment in most existing actuarial literature. In this paper, we explore and investigate the use of exponential family principal component analysis (EPCA) to analyze compositional data in insurance. The method is applied to analyze a dataset obtained from the U.S. Mine Safety and Health Administration. The numerical results show that EPCA is able to produce principal components that are significant predictors and improve the prediction accuracy of the regression model. The EPCA method can be a promising useful tool for actuaries to analyze compositional data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDebiasing Sample Loadings and Scores in Exponential Family PCA for Sparse Count Data

Yoonkyung Lee, Ruochen Huang

| Title | Authors | Year | Actions |

|---|

Comments (0)