Summary

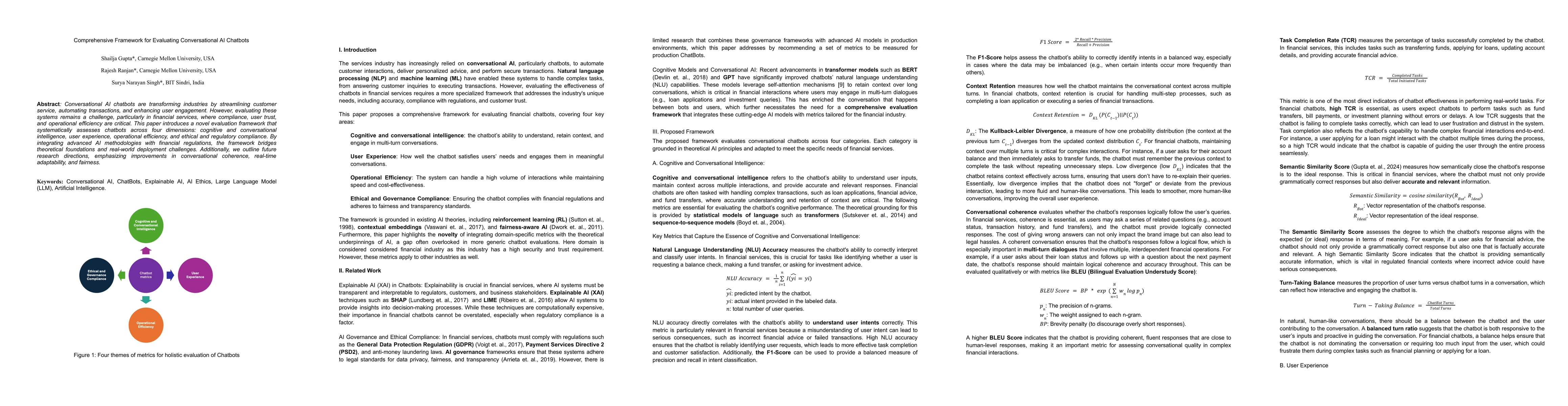

Conversational AI chatbots are transforming industries by streamlining customer service, automating transactions, and enhancing user engagement. However, evaluating these systems remains a challenge, particularly in financial services, where compliance, user trust, and operational efficiency are critical. This paper introduces a novel evaluation framework that systematically assesses chatbots across four dimensions: cognitive and conversational intelligence, user experience, operational efficiency, and ethical and regulatory compliance. By integrating advanced AI methodologies with financial regulations, the framework bridges theoretical foundations and real-world deployment challenges. Additionally, we outline future research directions, emphasizing improvements in conversational coherence, real-time adaptability, and fairness.

AI Key Findings

Generated Jun 11, 2025

Methodology

The paper introduces a comprehensive evaluation framework for conversational AI chatbots in financial services, integrating advanced AI methodologies with financial regulations.

Key Results

- The framework assesses chatbots across four dimensions: cognitive and conversational intelligence, user experience, operational efficiency, and ethical and regulatory compliance.

- Task Completion Rate (TCR) is identified as a crucial metric for chatbot effectiveness, especially in financial services where tasks like fund transfers and loan applications are common.

- Semantic Similarity Score measures the semantic closeness of chatbot responses to ideal responses, ensuring accurate and relevant information delivery, which is vital in regulated financial contexts.

- Turn-Taking Balance is highlighted as important for maintaining interactive and engaging conversations, especially during complex financial tasks.

- User Experience metrics like Customer Satisfaction (CSAT) and Net Promoter Score (NPS) are emphasized for maintaining customer satisfaction and driving long-term retention.

Significance

This research is significant as it addresses the challenge of evaluating conversational AI chatbots in financial services, where compliance, user trust, and operational efficiency are critical. The proposed framework bridges theoretical foundations and real-world deployment challenges, providing actionable metrics for chatbot developers and financial institutions.

Technical Contribution

The paper presents a novel evaluation framework that systematically assesses chatbots across multiple dimensions, integrating advanced AI methodologies with financial regulations.

Novelty

The framework's novelty lies in its holistic approach to chatbot evaluation in financial services, incorporating regulatory compliance metrics tailored for the industry and emphasizing the need for chatbots to dynamically adjust to market changes and regulatory updates.

Limitations

- The paper does not detail the practical implementation challenges of integrating advanced AI methodologies with financial regulations.

- Potential limitations in the generalizability of the framework across diverse financial services and varying user demographics are not discussed.

Future Work

- Future research should focus on enhancing conversational coherence through hybrid models combining transformers and reinforcement learning.

- Improving real-time adaptability of chatbots to regulatory changes and market conditions through meta-reinforcement learning is suggested.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIntellAgent: A Multi-Agent Framework for Evaluating Conversational AI Systems

Elad Levi, Ilan Kadar

A Framework for Evaluating Appropriateness, Trustworthiness, and Safety in Mental Wellness AI Chatbots

Ben Krause, Lucia Chen, David A. Preece et al.

No citations found for this paper.

Comments (0)