Summary

Different approaches to defining dynamic market risk measures are available in the literature. Most are focused or derived from probability theory, economic behavior or dynamic programming. Here, we propose an approach to define and implement dynamic market risk measures based on recursion and state economy representation. The proposed approach is to be implementable and to inherit properties from static market risk measures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

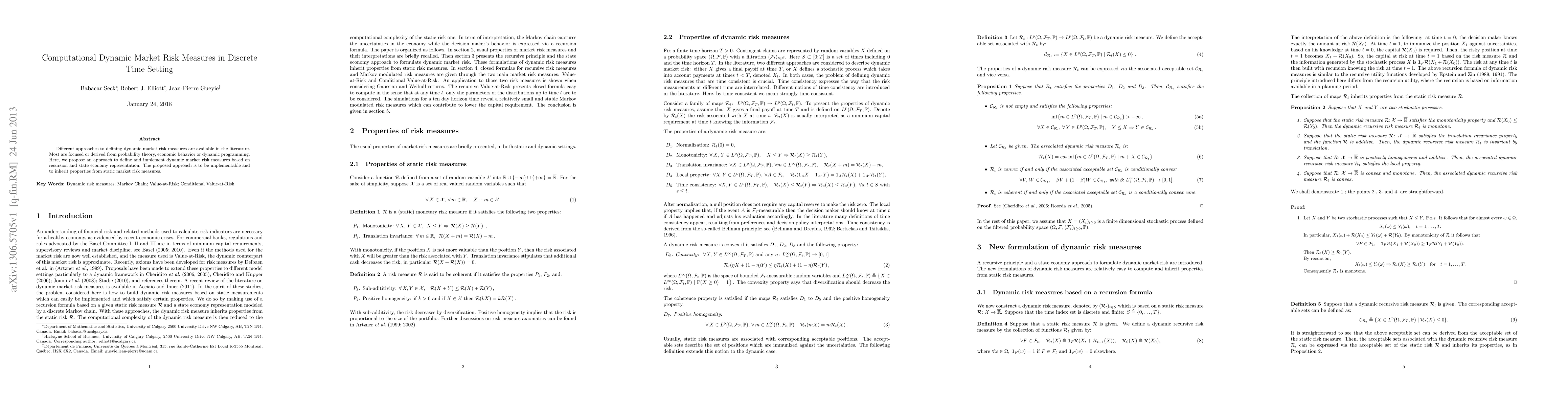

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)