Summary

Value-at-Risk (VaR) is one of the main regulatory tools used for risk management purposes. However, it is difficult to compute optimal VaR portfolios; that is, an optimal risk-reward portfolio allocation using VaR as the risk measure. This is due to VaR being non-convex and of combinatorial nature. In particular, it is well known that the VaR portfolio problem can be formulated as a mixed integer linear program (MILP) that is difficult to solve with current MILP solvers for medium to large-scale instances of the problem. Here, we present an algorithm to compute near-optimal VaR portfolios that takes advantage of this MILP formulation and provides a guarantee of the solution's near-optimality. As a byproduct, we obtain an algorithm to compute tight lower bounds on the VaR portfolio problem that outperform related algorithms proposed in the literature for this purpose. The near-optimality guarantee provided by the proposed algorithm is obtained thanks to the relation between minimum risk portfolios satisfying a reward benchmark and the corresponding maximum reward portfolios satisfying a risk benchmark. These alternate formulations of the portfolio allocation problem have been frequently studied in the case of convex risk measures and concave reward functions. Here, this relationship is considered for general risk measures and reward functions. To illustrate the efficiency of the presented algorithm, numerical results are presented using historical asset returns from the US financial market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

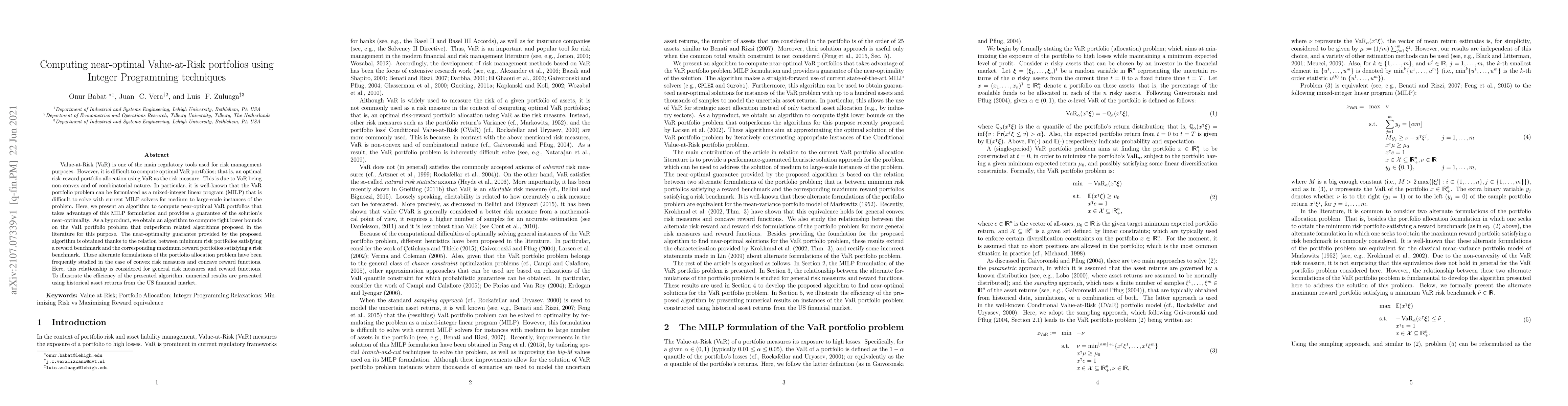

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)