Summary

In several real-world applications involving decision making under uncertainty, the traditional expected value objective may not be suitable, as it may be necessary to control losses in the case of a rare but extreme event. Conditional Value-at-Risk (CVaR) is a popular risk measure for modeling the aforementioned objective. We consider the problem of estimating CVaR from i.i.d. samples of an unbounded random variable, which is either sub-Gaussian or sub-exponential. We derive a novel one-sided concentration bound for a natural sample-based CVaR estimator in this setting. Our bound relies on a concentration result for a quantile-based estimator for Value-at-Risk (VaR), which may be of independent interest.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

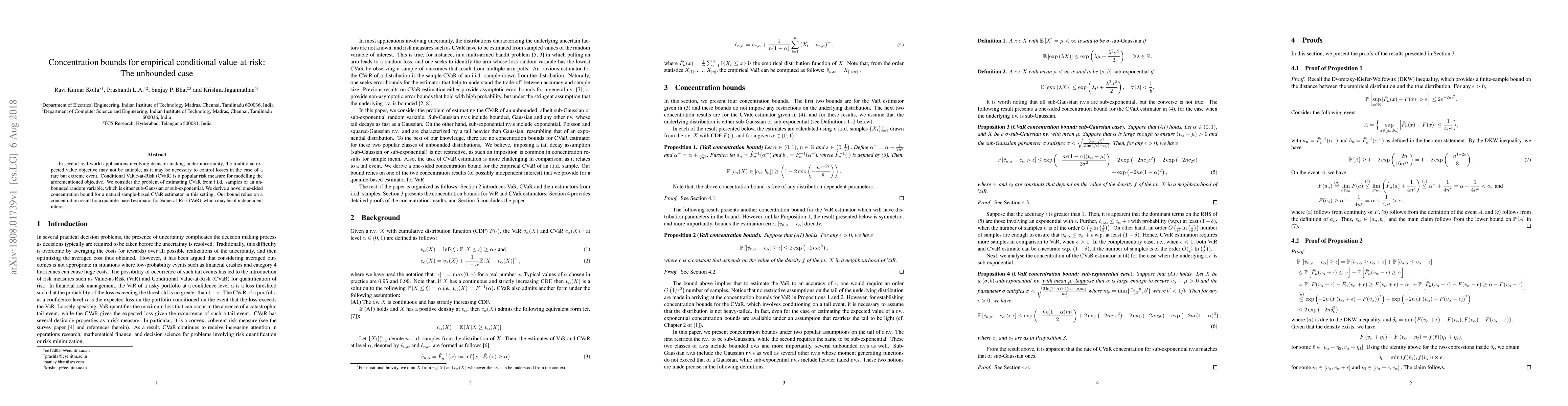

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)