Summary

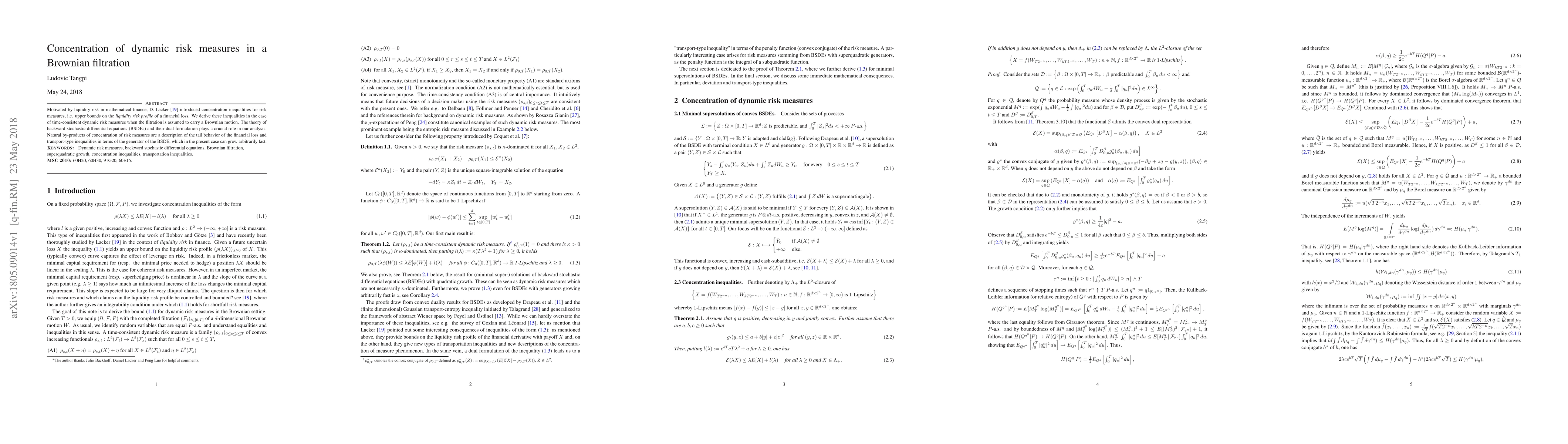

Motivated by liquidity risk in mathematical finance, D. Lacker introduced concentration inequalities for risk measures, i.e. upper bounds on the \emph{liquidity risk profile} of a financial loss. We derive these inequalities in the case of time-consistent dynamic risk measures when the filtration is assumed to carry a Brownian motion. The theory of backward stochastic differential equations (BSDEs) and their dual formulation plays a crucial role in our analysis. Natural by-products of concentration of risk measures are a description of the tail behavior of the financial loss and transport-type inequalities in terms of the generator of the BSDE, which in the present case can grow arbitrarily fast.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)