Summary

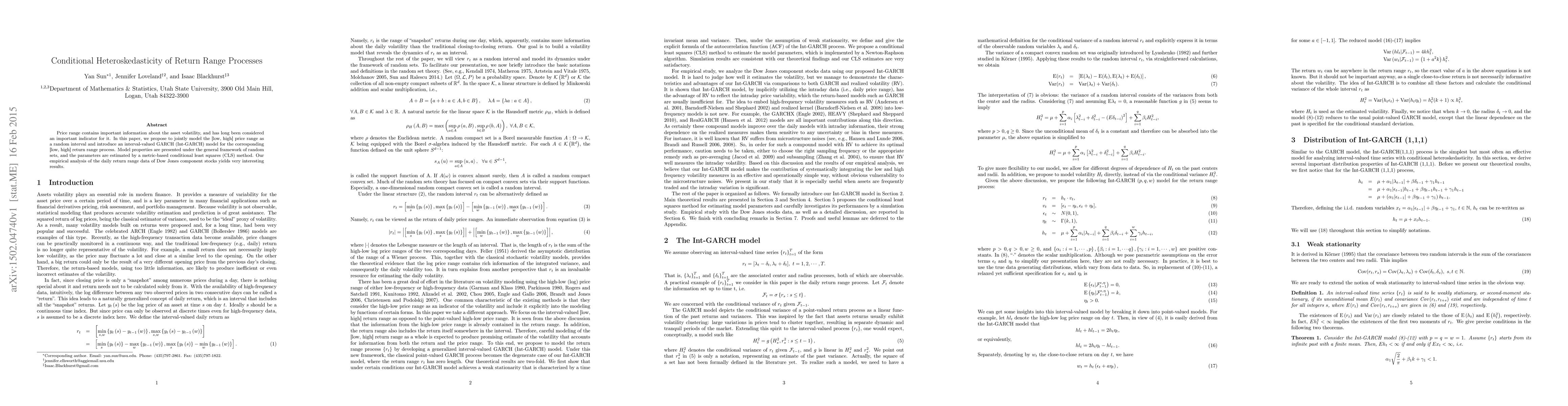

Price range contains important information about the asset volatility, and has long been considered an important indicator for it. In this paper, we propose to jointly model the [low, high] price range as a random interval and introduce an interval-valued GARCH (Int-GARCH) model for the corresponding [low, high] return range process. Model properties are presented under the general framework of random sets, and the parameters are estimated by a metric-based conditional least squares (CLS) method. Our empirical analysis of the daily return range data of Dow Jones component stocks yields very interesting results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNeural Generalised AutoRegressive Conditional Heteroskedasticity

Paolo Barucca, Zexuan Yin

ROLCH: Regularized Online Learning for Conditional Heteroskedasticity

Simon Hirsch, Jonathan Berrisch, Florian Ziel

| Title | Authors | Year | Actions |

|---|

Comments (0)