Summary

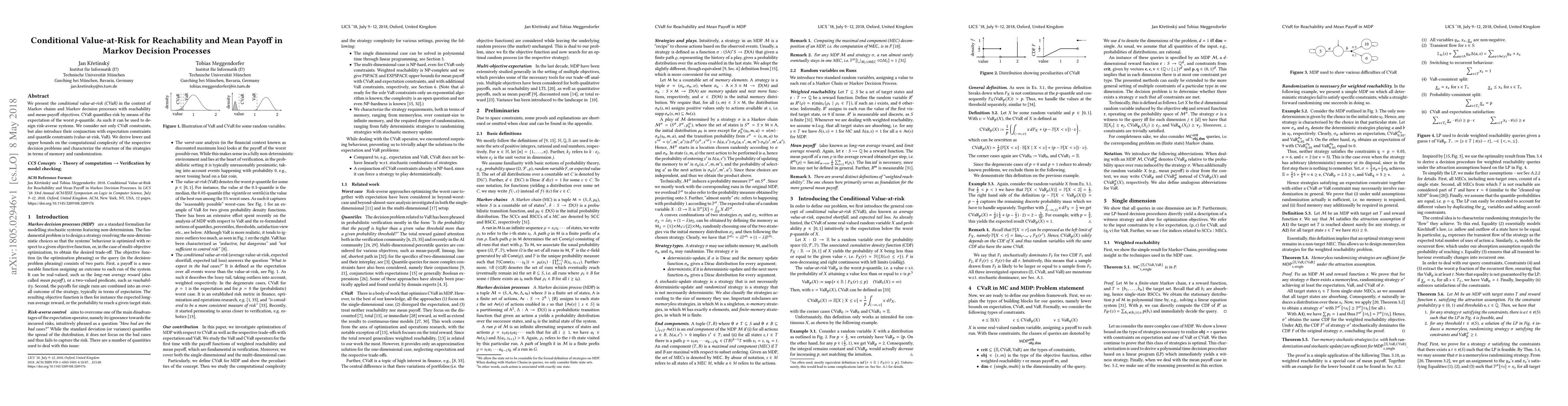

We present the conditional value-at-risk (CVaR) in the context of Markov chains and Markov decision processes with reachability and mean-payoff objectives. CVaR quantifies risk by means of the expectation of the worst p-quantile. As such it can be used to design risk-averse systems. We consider not only CVaR constraints, but also introduce their conjunction with expectation constraints and quantile constraints (value-at-risk, VaR). We derive lower and upper bounds on the computational complexity of the respective decision problems and characterize the structure of the strategies in terms of memory and randomization.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimising expectation with guarantees for window mean payoff in Markov decision processes

Pranshu Gaba, Shibashis Guha

| Title | Authors | Year | Actions |

|---|

Comments (0)