Summary

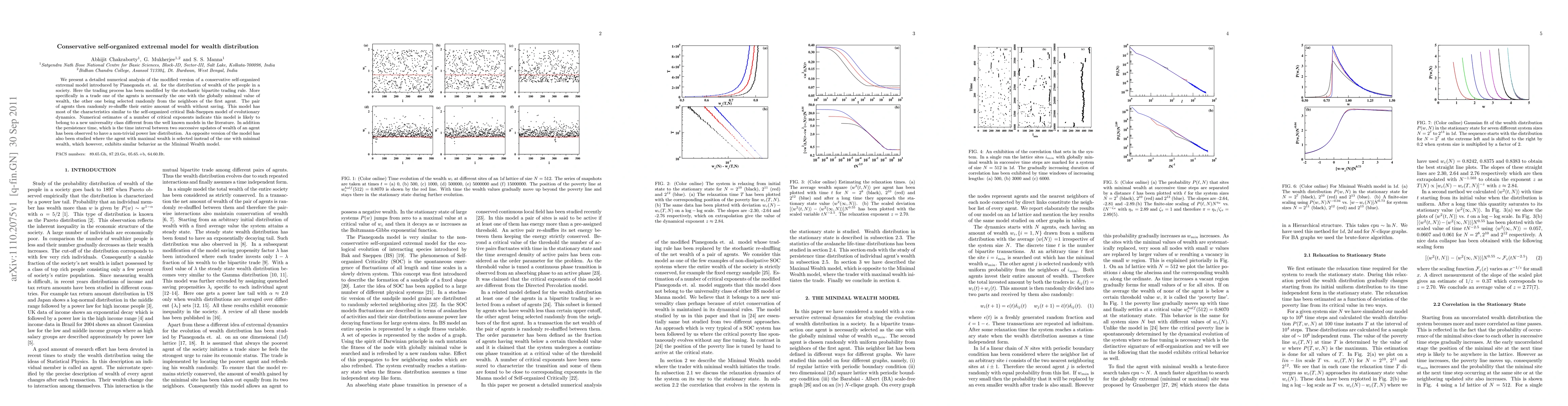

We present a detailed numerical analysis of the modified version of a conservative self-organized extremal model introduced by Pianegonda et. al. for the distribution of wealth of the people in a society. Here the trading process has been modified by the stochastic bipartite trading rule. More specifically in a trade one of the agents is necessarily the one with the globally minimal value of wealth, the other one being selected randomly from the neighbors of the first agent. The pair of agents then randomly re-shuffle their entire amount of wealth without saving. This model has most of the characteristics similar to the self-organized critical Bak-Sneppen model of evolutionary dynamics. Numerical estimates of a number of critical exponents indicate this model is likely to belong to a new universality class different from the well known models in the literature. In addition the persistence time, which is the time interval between two successive updates of wealth of an agent has been observed to have a non-trivial power law distribution. An opposite version of the model has also been studied where the agent with maximal wealth is selected instead of the one with minimal wealth, which however, exhibits similar behavior as the Minimal Wealth model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInequalities of wealth distribution in a conservative economy

S. Pianegonda, J. R. Iglesias

Correlation time in extremal self-organized critical models

Rahul Chhimpa, Abha Singh, Avinash Chand Yadav

| Title | Authors | Year | Actions |

|---|

Comments (0)