Authors

Summary

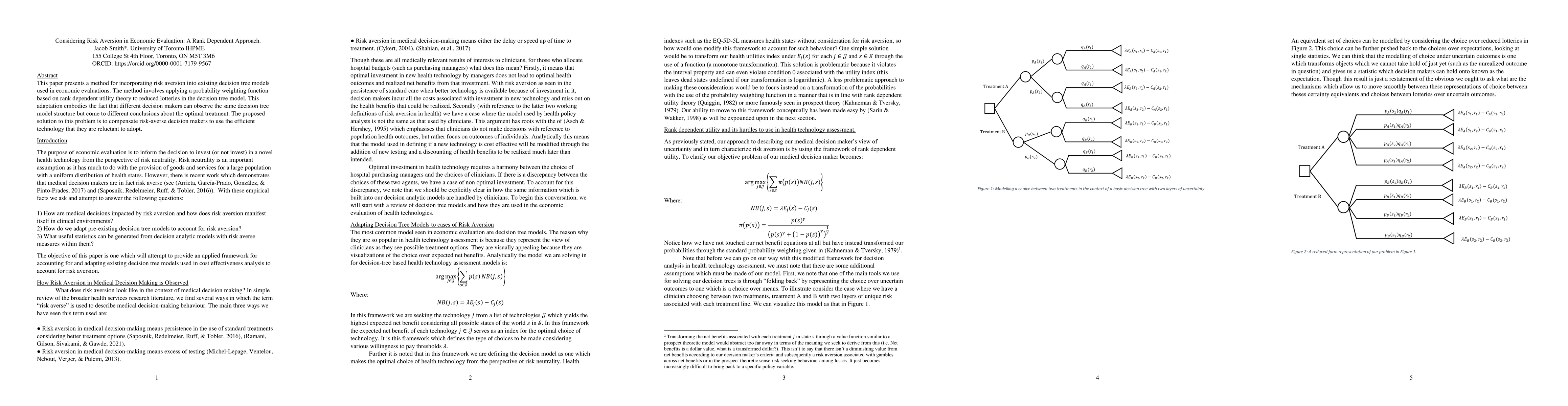

This paper presents a method for incorporating risk aversion into existing decision tree models used in economic evaluations. The method involves applying a probability weighting function based on rank dependent utility theory to reduced lotteries in the decision tree model. This adaptation embodies the fact that different decision makers can observe the same decision tree model structure but come to different conclusions about the optimal treatment. The proposed solution to this problem is to compensate risk-averse decision makers to use the efficient technology that they are reluctant to adopt.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk aversion in economic transactions

C. Anteneodo, C. Tsallis, A. S. Martinez

No citations found for this paper.

Comments (0)