Authors

Summary

We consider the social welfare that can be facilitated by a constant function market maker (CFMM). When there is sufficient liquidity available to the CFMM, it can approximate the optimal social welfare when all users transactions are executed. When one of the agent has the role of proposing the block, and blockspace is scarce, they can obtain higher expected utility than otherwise identical agents. This gives a lower bound on the maximal extractable value exposed when blockspace is scarce.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

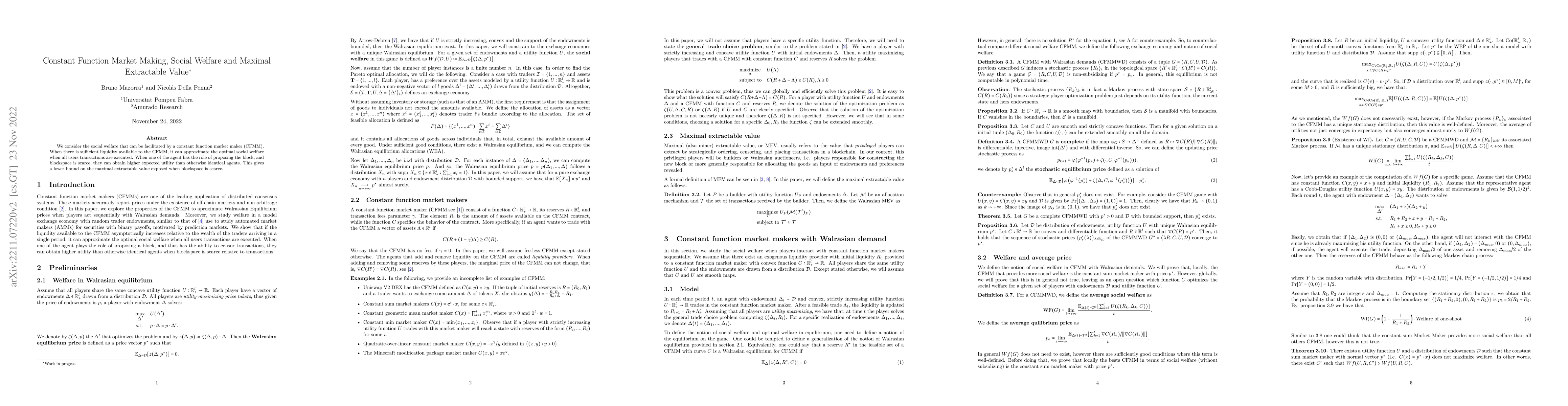

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTowards a Theory of Maximal Extractable Value I: Constant Function Market Makers

Kshitij Kulkarni, Theo Diamandis, Tarun Chitra

| Title | Authors | Year | Actions |

|---|

Comments (0)