Summary

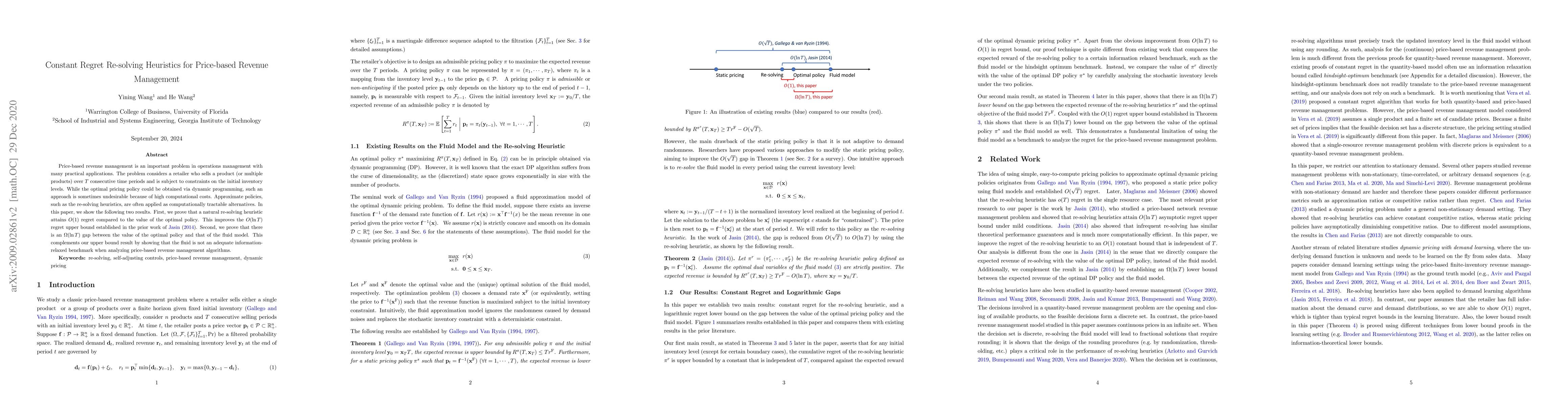

Price-based revenue management is an important problem in operations management with many practical applications. The problem considers a retailer who sells a product (or multiple products) over $T$ consecutive time periods and is subject to constraints on the initial inventory levels. While the optimal pricing policy could be obtained via dynamic programming, such an approach is sometimes undesirable because of high computational costs. Approximate policies, such as the re-solving heuristics, are often applied as computationally tractable alternatives. In this paper, we show the following two results. First, we prove that a natural re-solving heuristic attains $O(1)$ regret compared to the value of the optimal policy. This improves the $O(\ln T)$ regret upper bound established in the prior work of \cite{jasin2014reoptimization}. Second, we prove that there is an $\Omega(\ln T)$ gap between the value of the optimal policy and that of the fluid model. This complements our upper bound result by showing that the fluid is not an adequate information-relaxed benchmark when analyzing price-based revenue management algorithms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRevenue Management Under the Markov Chain Choice Model with Joint Price and Assortment Decisions

Anton J. Kleywegt, Hongzhang Shao

Near-Optimal Primal-Dual Algorithms for Quantity-Based Network Revenue Management

Zijie Zhou, Xinshang Wang, Rui Sun

Degeneracy is OK: Logarithmic Regret for Network Revenue Management with Indiscrete Distributions

Jiawei Zhang, Will Ma, Jiashuo Jiang

No citations found for this paper.

Comments (0)