Summary

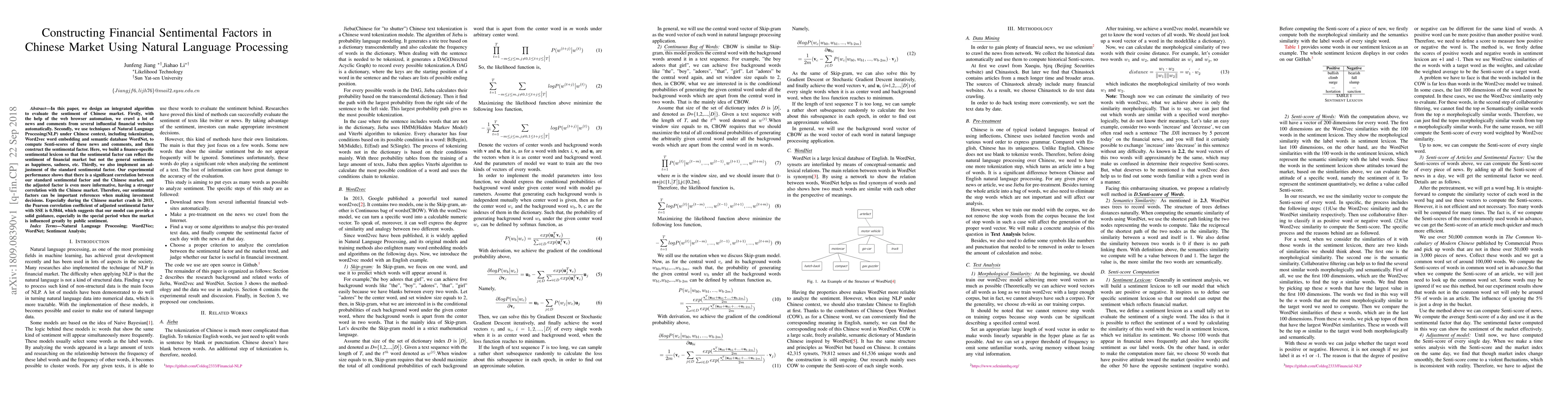

In this paper, we design an integrated algorithm to evaluate the sentiment of Chinese market. Firstly, with the help of the web browser automation, we crawl a lot of news and comments from several influential financial websites automatically. Secondly, we use techniques of Natural Language Processing(NLP) under Chinese context, including tokenization, Word2vec word embedding and semantic database WordNet, to compute Senti-scores of these news and comments, and then construct the sentimental factor. Here, we build a finance-specific sentimental lexicon so that the sentimental factor can reflect the sentiment of financial market but not the general sentiments as happiness, sadness, etc. Thirdly, we also implement an adjustment of the standard sentimental factor. Our experimental performance shows that there is a significant correlation between our standard sentimental factor and the Chinese market, and the adjusted factor is even more informative, having a stronger correlation with the Chinese market. Therefore, our sentimental factors can be important references when making investment decisions. Especially during the Chinese market crash in 2015, the Pearson correlation coefficient of adjusted sentimental factor with SSE is 0.5844, which suggests that our model can provide a solid guidance, especially in the special period when the market is influenced greatly by public sentiment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredicting Financial Market Trends using Time Series Analysis and Natural Language Processing

Ali Asgarov

Natural Language Processing for Financial Regulation

Ixandra Achitouv, Antoine Jacquier, Dragos Gorduza

Application of Natural Language Processing in Financial Risk Detection

Yu Cheng, Liyang Wang, Haowei Yang et al.

Stock Market Prediction using Natural Language Processing -- A Survey

Om Mane, Saravanakumar kandasamy

| Title | Authors | Year | Actions |

|---|

Comments (0)