Summary

We consider the problem of optimal portfolio selection under forward investment performance criteria in an incomplete market. Given multiple traded assets, the prices of which depend on multiple observable stochastic factors, we construct a large class of forward performance processes with power-utility initial data, as well as the corresponding optimal portfolios. This is done by solving the associated non-linear parabolic partial differential equations (PDEs) posed in the "wrong" time direction, for stock-factor correlation matrices with eigenvalue equality (EVE) structure, which we introduce here. Along the way we establish on domains an explicit form of the generalized Widder's theorem of Nadtochiy and Tehranchi [NT15, Theorem 3.12] and rely hereby on the Laplace inversion in time of the solutions to suitable linear parabolic PDEs posed in the "right" time direction.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

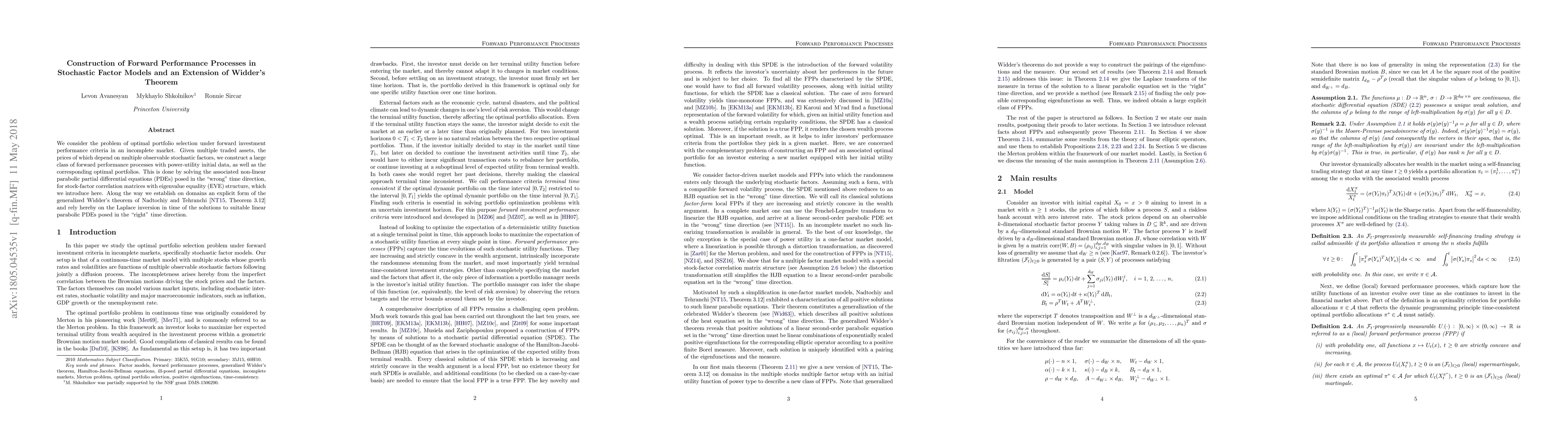

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)