Authors

Summary

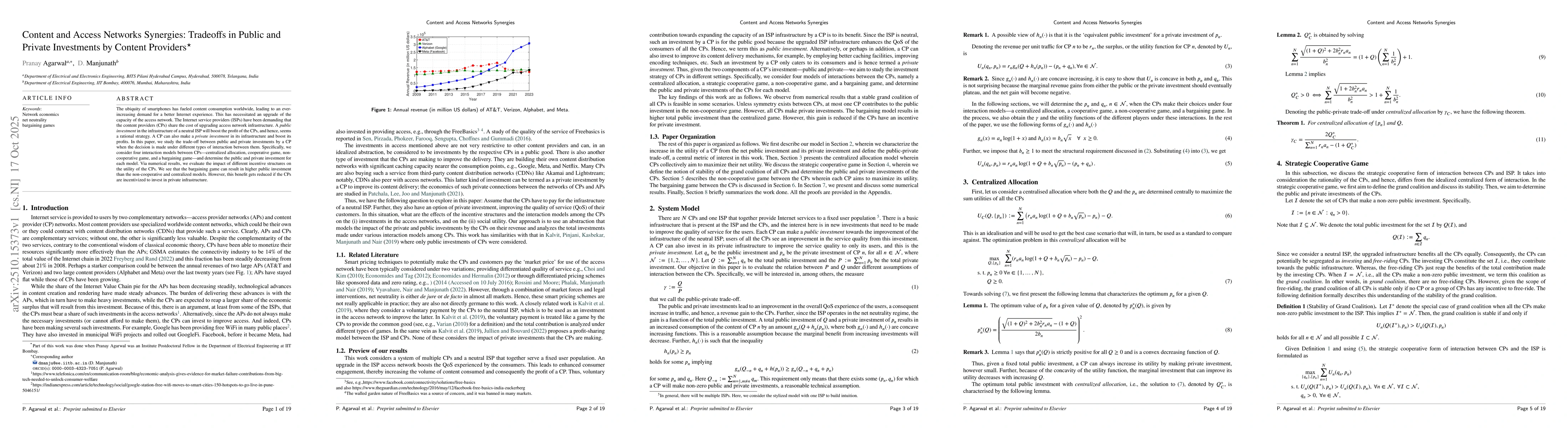

The ubiquity of smartphones has fueled content consumption worldwide, leading to an ever-increasing demand for a better Internet experience. This has necessitated an upgrade of the capacity of the access network. The Internet service providers (ISPs) have been demanding that the content providers (CPs) share the cost of upgrading access network infrastructure. A \emph{public investment} in the infrastructure of a neutral ISP will boost the profit of the CPs, and hence, seems a rational strategy. A CP can also make a \emph{private investment} in its infrastructure and boost its profits. In this paper, we study the trade-off between public and private investments by a CP when the decision is made under different types of interaction between them. Specifically, we consider four interaction models between CPs -- centralized allocation, cooperative game, non-cooperative game, and a bargaining game -- and determine the public and private investment for each model. Via numerical results, we evaluate the impact of different incentive structures on the utility of the CPs. We see that the bargaining game can result in higher public investment than the non-cooperative and centralized models. However, this benefit gets reduced if the CPs are incentivized to invest in private infrastructure.

AI Key Findings

Generated Oct 21, 2025

Methodology

The research employs a combination of theoretical analysis and empirical evaluation to study the impact of network neutrality on content providers' investment incentives and the economic implications of zero-rating practices.

Key Results

- The study finds that network neutrality regulations can influence content providers' investment decisions by affecting their ability to negotiate favorable interconnection terms.

- Zero-rating practices may create market distortions by giving certain content providers an unfair advantage over others.

- The analysis reveals that the economic outcomes of network neutrality policies depend on the specific market structure and regulatory framework in place.

Significance

This research is significant as it provides insights into the complex interplay between network neutrality, content provider strategies, and market dynamics, which has important implications for policymakers and industry stakeholders.

Technical Contribution

The paper develops a novel framework for analyzing the economic implications of network neutrality and zero-rating practices, incorporating game-theoretic models and welfare analysis.

Novelty

This work introduces a unique perspective by integrating content provider investment incentives with network neutrality policy analysis, offering a comprehensive understanding of the economic trade-offs involved.

Limitations

- The study relies on theoretical models and may not fully capture real-world complexities.

- The analysis assumes a static market environment, which may not reflect dynamic market conditions.

- The findings are based on specific assumptions about content provider behavior and may not generalize to all scenarios.

Future Work

- Further empirical studies using real-world data could validate the theoretical findings.

- Investigating the long-term effects of network neutrality policies on market competition and innovation.

- Exploring the impact of emerging technologies such as 5G and edge computing on network neutrality debates.

Comments (0)