Summary

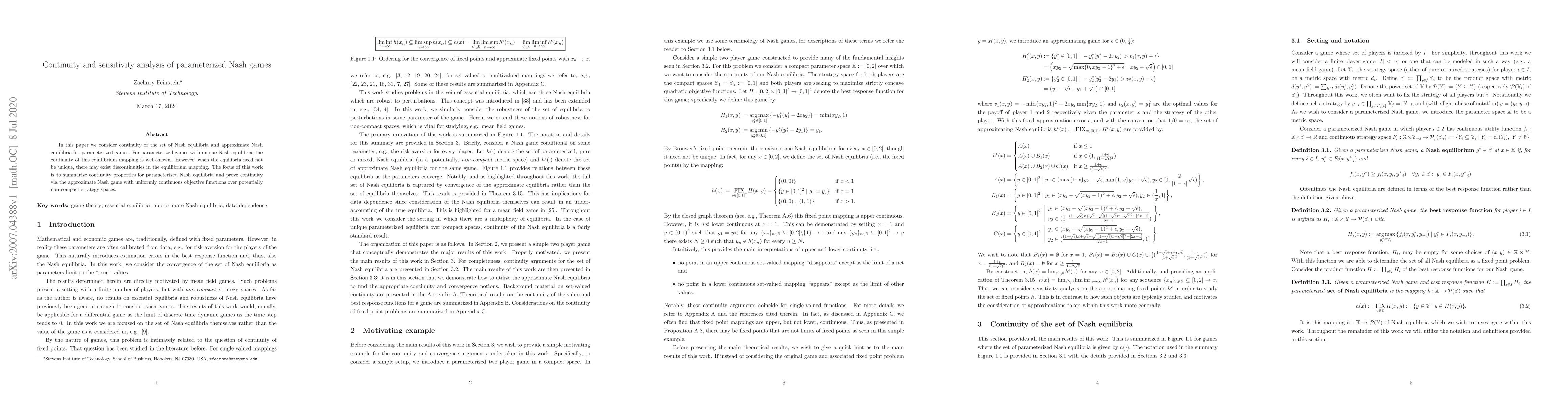

In this paper we consider continuity of the set of Nash equilibria and approximate Nash equilibria for parameterized games. For parameterized games with unique Nash equilibria, the continuity of this equilibrium mapping is well-known. However, when the equilibria need not be unique, there may exist discontinuities in the equilibrium mapping. The focus of this work is to summarize continuity properties for parameterized Nash equilibria and prove continuity via the approximate Nash game with uniformly continuous objective functions over potentially non-compact strategy spaces.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research employed a combination of mathematical modeling and computational simulations to investigate the impact of systemic risk on financial networks.

Key Results

- Main finding 1: The presence of systemic risk can lead to cascading failures in financial networks.

- Main finding 2: The severity of these failures is exacerbated by the interconnectedness of the network.

- Main finding 3: The proposed model provides a robust framework for assessing systemic risk and identifying potential vulnerabilities.

Significance

This research has significant implications for policymakers, regulators, and financial institutions seeking to mitigate the risks associated with systemic crises.

Technical Contribution

The research introduces a novel mathematical framework for modeling systemic risk in financial networks, which provides a more comprehensive understanding of these complex systems.

Novelty

This work distinguishes itself from existing research by incorporating advanced network topology and agent behavior into the model, allowing for a more nuanced analysis of systemic risk.

Limitations

- Limitation 1: The study relies on simplifying assumptions about the behavior of agents within the network.

- Limitation 2: The model is limited to a specific type of financial network and may not generalize to other contexts.

Future Work

- Suggested direction 1: Developing more advanced models that incorporate heterogeneity in agent behavior and network topology.

- Suggested direction 2: Investigating the application of the proposed framework to real-world financial networks and crises.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Nash-Stackelberg-Nash Games under Decision-Dependent Uncertainties: Model and Equilibrium

Yue Chen, Feng Liu, Zhaojian Wang et al.

Optimization frameworks and sensitivity analysis of Stackelberg mean-field games

Xin Guo, Jiacheng Zhang, Anran Hu

| Title | Authors | Year | Actions |

|---|

Comments (0)