Summary

We consider a class of generalized capital asset pricing models in continuous time with a finite number of agents and tradable securities. The securities may not be sufficient to span all sources of uncertainty. If the agents have exponential utility functions and the individual endowments are spanned by the securities, an equilibrium exists and the agents' optimal trading strategies are constant. Affine processes, and the theory of information-based asset pricing are used to model the endogenous asset price dynamics and the terminal payoff. The derived semi-explicit pricing formulae are applied to numerically analyze the impact of the agents' risk aversion on the implied volatility of simultaneously-traded European-style options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

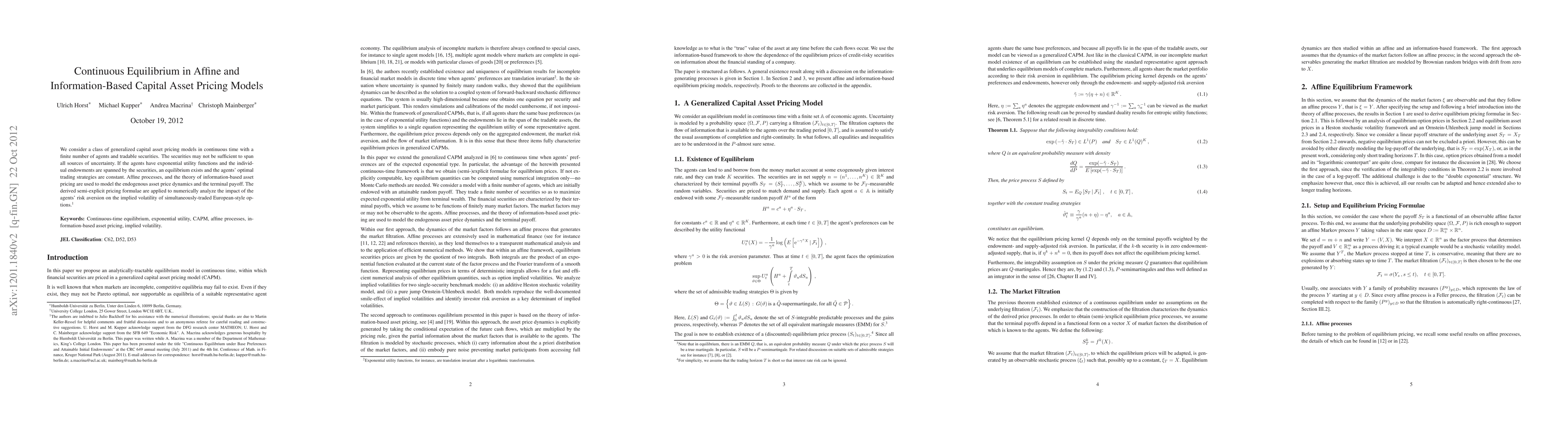

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)