Authors

Summary

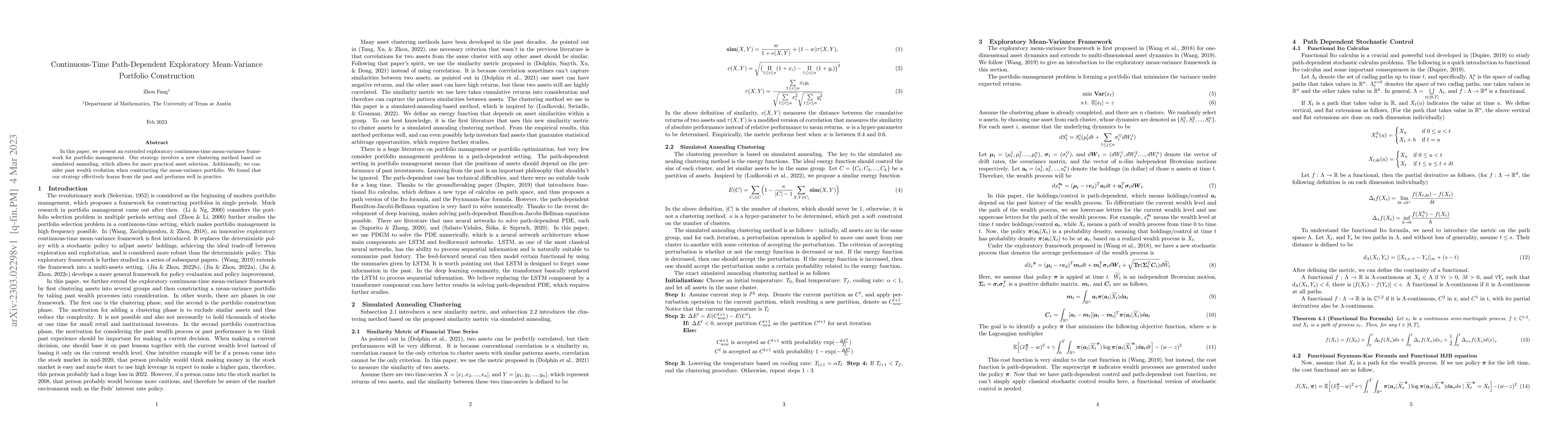

In this paper, we present an extended exploratory continuous-time mean-variance framework for portfolio management. Our strategy involves a new clustering method based on simulated annealing, which allows for more practical asset selection. Additionally, we consider past wealth evolution when constructing the mean-variance portfolio. We found that our strategy effectively learns from the past and performs well in practice.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExploratory mean-variance portfolio selection with Choquet regularizers

Hao Wang, Xia Han, Junyi Guo

Exploratory Mean-Variance Portfolio Optimization with Regime-Switching Market Dynamics

Bin Li, David Saunders, Yuling Max Chen

No citations found for this paper.

Comments (0)