Authors

Summary

We develop a new continuous-time stochastic gradient descent method for optimizing over the stationary distribution of stochastic differential equation (SDE) models. The algorithm continuously updates the SDE model's parameters using an estimate for the gradient of the stationary distribution. The gradient estimate is simultaneously updated using forward propagation of the SDE state derivatives, asymptotically converging to the direction of steepest descent. We rigorously prove convergence of the online forward propagation algorithm for linear SDE models (i.e., the multi-dimensional Ornstein-Uhlenbeck process) and present its numerical results for nonlinear examples. The proof requires analysis of the fluctuations of the parameter evolution around the direction of steepest descent. Bounds on the fluctuations are challenging to obtain due to the online nature of the algorithm (e.g., the stationary distribution will continuously change as the parameters change). We prove bounds for the solutions of a new class of Poisson partial differential equations (PDEs), which are then used to analyze the parameter fluctuations in the algorithm. Our algorithm is applicable to a range of mathematical finance applications involving statistical calibration of SDE models and stochastic optimal control for long time horizons where ergodicity of the data and stochastic process is a suitable modeling framework. Numerical examples explore these potential applications, including learning a neural network control for high-dimensional optimal control of SDEs and training stochastic point process models of limit order book events.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

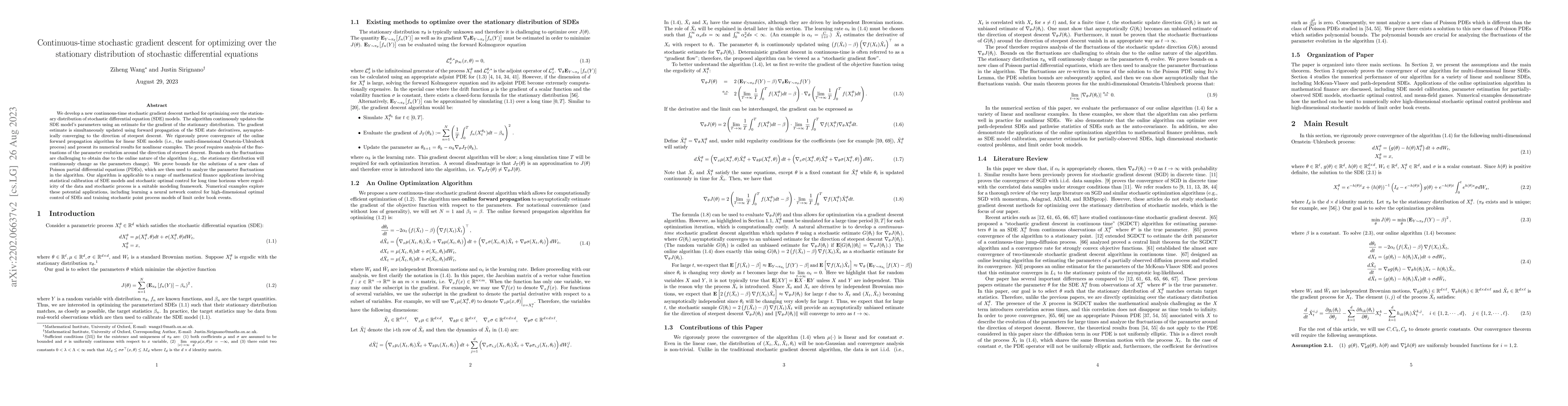

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStochastic Differential Equations models for Least-Squares Stochastic Gradient Descent

Adrien Schertzer, Loucas Pillaud-Vivien

| Title | Authors | Year | Actions |

|---|

Comments (0)