Summary

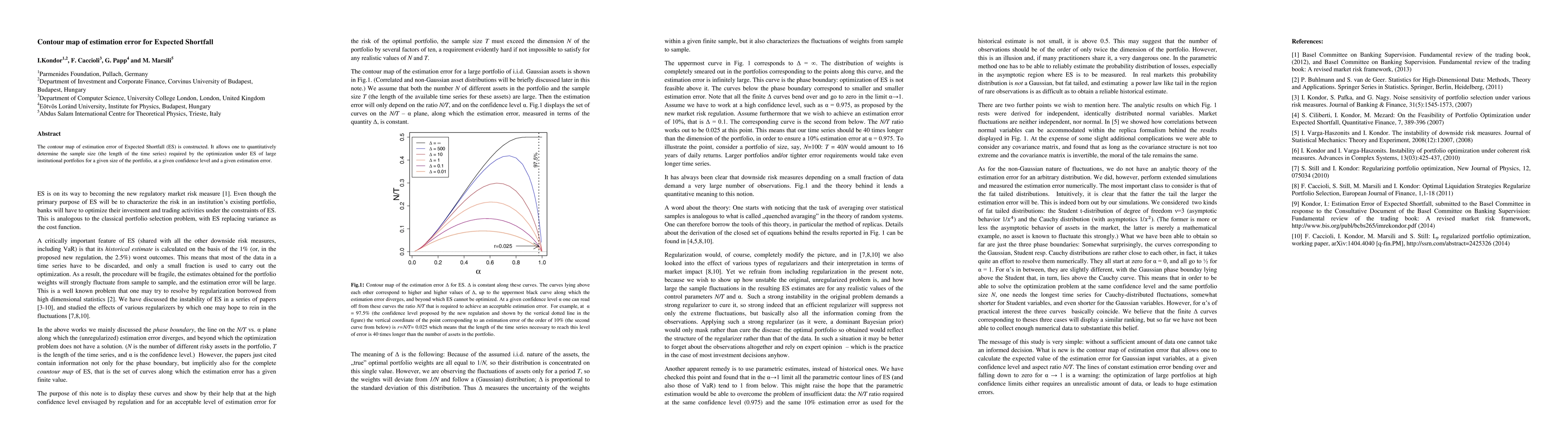

The contour map of estimation error of Expected Shortfall (ES) is constructed. It allows one to quantitatively determine the sample size (the length of the time series) required by the optimization under ES of large institutional portfolios for a given size of the portfolio, at a given confidence level and a given estimation error.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal nonparametric estimation of the expected shortfall risk

Daniel Bartl, Stephan Eckstein

Estimation of Expected Shortfall under Various Experimental Conditions

Jana Jurečková, Jan Kalina, Jan Večeř

| Title | Authors | Year | Actions |

|---|

Comments (0)