Authors

Summary

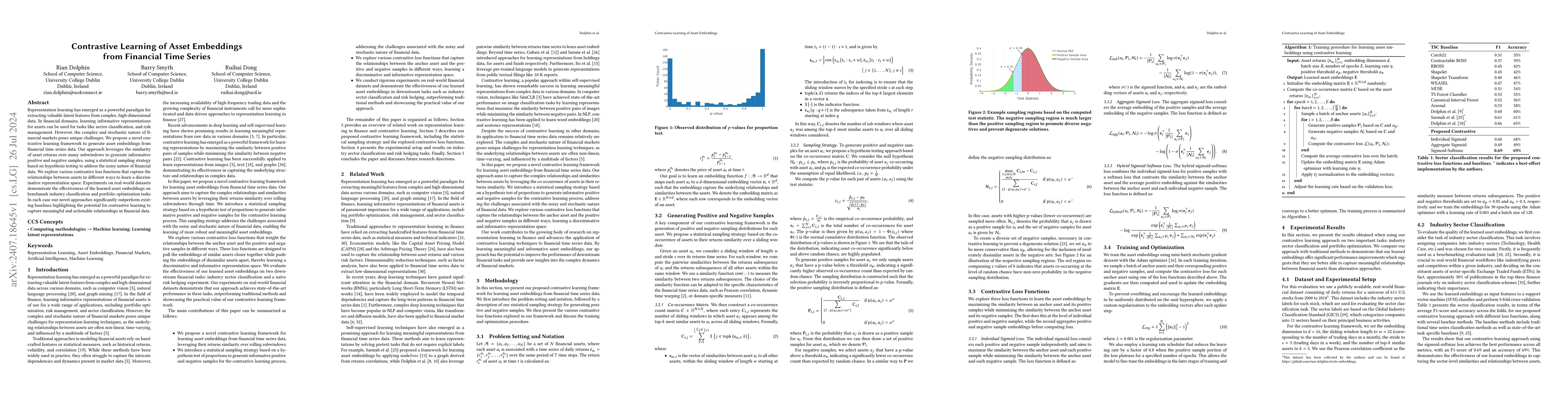

Representation learning has emerged as a powerful paradigm for extracting valuable latent features from complex, high-dimensional data. In financial domains, learning informative representations for assets can be used for tasks like sector classification, and risk management. However, the complex and stochastic nature of financial markets poses unique challenges. We propose a novel contrastive learning framework to generate asset embeddings from financial time series data. Our approach leverages the similarity of asset returns over many subwindows to generate informative positive and negative samples, using a statistical sampling strategy based on hypothesis testing to address the noisy nature of financial data. We explore various contrastive loss functions that capture the relationships between assets in different ways to learn a discriminative representation space. Experiments on real-world datasets demonstrate the effectiveness of the learned asset embeddings on benchmark industry classification and portfolio optimization tasks. In each case our novel approaches significantly outperform existing baselines highlighting the potential for contrastive learning to capture meaningful and actionable relationships in financial data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSoft Contrastive Learning for Time Series

Kibok Lee, Seunghan Lee, Taeyoung Park

Dynamic Contrastive Learning for Time Series Representation

Abdul-Kazeem Shamba, Kerstin Bach, Gavin Taylor

Contrastive Representation Learning for Predicting Solar Flares from Extremely Imbalanced Multivariate Time Series Data

Soukaina Filali Boubrahimi, Shah Muhammad Hamdi, Onur Vural

No citations found for this paper.

Comments (0)