Summary

The current global financial system forms a highly interconnected network where a default in one of its nodes can propagate to many other nodes, causing a catastrophic avalanche effect. In this paper we consider the problem of reducing the financial contagion by introducing some targeted interventions that can mitigate the cascaded failure effects. We consider a multi-step dynamic model of clearing payments and introduce an external control term that represents corrective cash injections made by a ruling authority. The proposed control model can be cast and efficiently solved as a linear program. We show via numerical examples that the proposed approach can significantly reduce the default propagation by applying small targeted cash injections.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

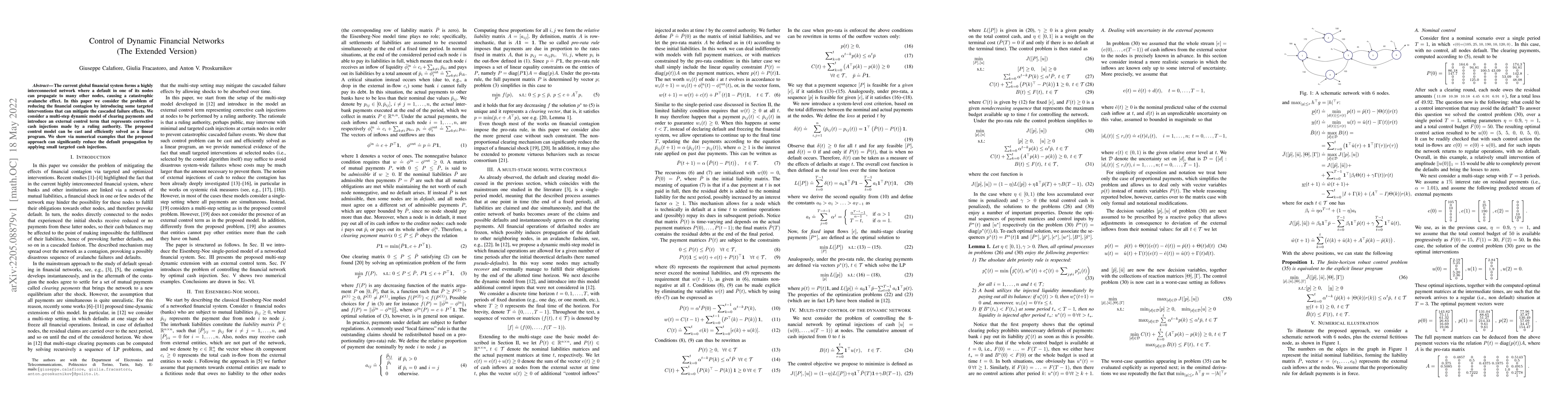

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersClearing Payments in Dynamic Financial Networks

Anton V. Proskurnikov, Giuseppe C. Calafiore, Giulia Fracastoro

Adaptive control of dynamic networks

Chunyu Pan, Changsheng Zhang, Xizhe Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)