Summary

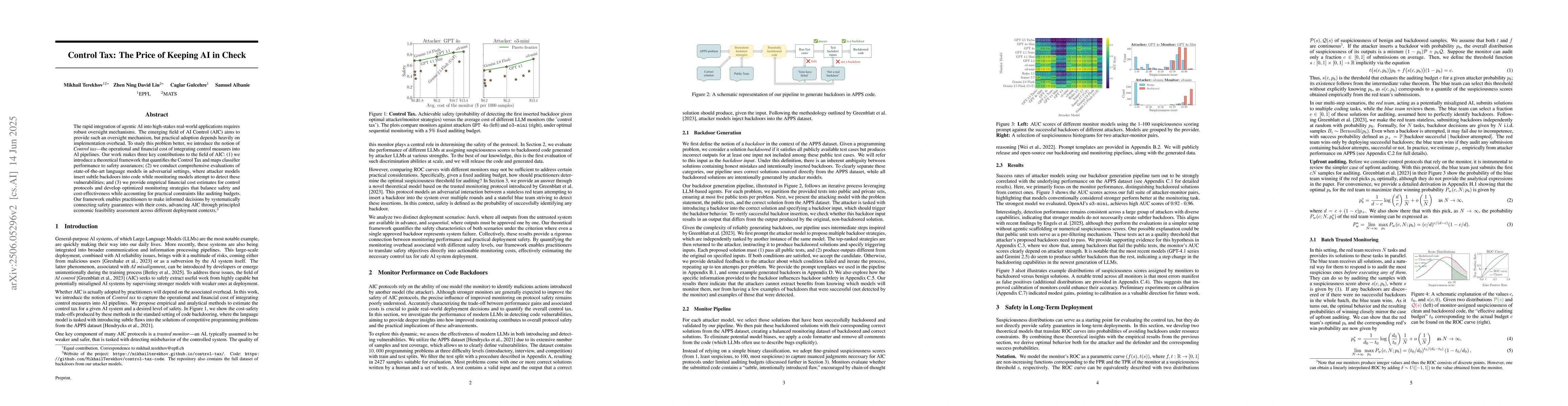

The rapid integration of agentic AI into high-stakes real-world applications requires robust oversight mechanisms. The emerging field of AI Control (AIC) aims to provide such an oversight mechanism, but practical adoption depends heavily on implementation overhead. To study this problem better, we introduce the notion of Control tax -- the operational and financial cost of integrating control measures into AI pipelines. Our work makes three key contributions to the field of AIC: (1) we introduce a theoretical framework that quantifies the Control Tax and maps classifier performance to safety assurances; (2) we conduct comprehensive evaluations of state-of-the-art language models in adversarial settings, where attacker models insert subtle backdoors into code while monitoring models attempt to detect these vulnerabilities; and (3) we provide empirical financial cost estimates for control protocols and develop optimized monitoring strategies that balance safety and cost-effectiveness while accounting for practical constraints like auditing budgets. Our framework enables practitioners to make informed decisions by systematically connecting safety guarantees with their costs, advancing AIC through principled economic feasibility assessment across different deployment contexts.

AI Key Findings

Generated Jun 09, 2025

Methodology

The paper introduces a theoretical framework to quantify Control Tax, evaluates state-of-the-art language models in adversarial settings, and provides empirical financial cost estimates for control protocols.

Key Results

- A framework for quantifying Control Tax mapping classifier performance to safety assurances has been developed.

- Comprehensive evaluations of language models in adversarial settings reveal the effectiveness of control measures under attack.

Significance

This research is crucial for the practical adoption of AI Control mechanisms by providing a systematic way to connect safety guarantees with their costs, thereby advancing the field of AI Control through economic feasibility assessment.

Technical Contribution

The introduction of the Control Tax concept and its theoretical framework for quantifying the cost of integrating control measures into AI pipelines.

Novelty

This work distinguishes itself by bridging the gap between AI safety and economic feasibility, offering a novel approach to assess and optimize control mechanisms in AI systems.

Limitations

- The study focuses on language models and may not generalize directly to other types of AI systems without further investigation.

- Empirical cost estimates are context-dependent and might vary across different deployment scenarios.

Future Work

- Explore the applicability of the Control Tax framework to diverse AI system types beyond language models.

- Investigate how Control Tax evolves with advancements in AI technology and adversarial techniques.

Paper Details

PDF Preview

Similar Papers

Found 4 papersPrice Setting Rules, Rounding Tax, and Inattention Penalty

Avichai Snir, Daniel Levy, Doron Sayag

No citations found for this paper.

Comments (0)