Summary

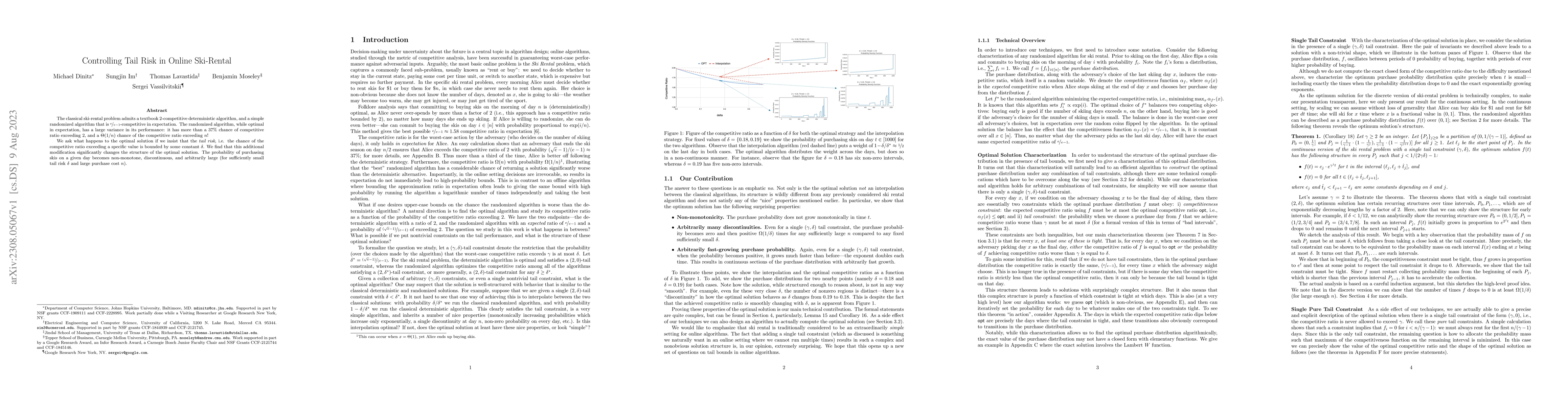

The classical ski-rental problem admits a textbook 2-competitive deterministic algorithm, and a simple randomized algorithm that is $\frac{e}{e-1}$-competitive in expectation. The randomized algorithm, while optimal in expectation, has a large variance in its performance: it has more than a 37% chance of competitive ratio exceeding 2, and a $\Theta(1/n)$ chance of the competitive ratio exceeding $n$! We ask what happens to the optimal solution if we insist that the tail risk, i.e., the chance of the competitive ratio exceeding a specific value, is bounded by some constant $\delta$. We find that this additional modification significantly changes the structure of the optimal solution. The probability of purchasing skis on a given day becomes non-monotone, discontinuous, and arbitrarily large (for sufficiently small tail risk $\delta$ and large purchase cost $n$).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)